When you begin trading, you would want to avoid unnecessary risky trades. That’s when learning chart patterns becomes essential, as they are easy to identify and trade with a better understanding of price action, allowing for more efficient trading. They also help you identify the potential reversals and continuations in the price chart. One among those is the Pipe Bottom chart pattern.

In this article, we will understand the Pipe Bottom Pattern, its structure, how to identify it, how to trade it with an example, its advantages, and disadvantages.

What is the Pipe Bottom Pattern?

The Pipe Bottom Pattern is a bullish reversal chart pattern used to identify potential trend reversals from bearish movement to bullish movement.

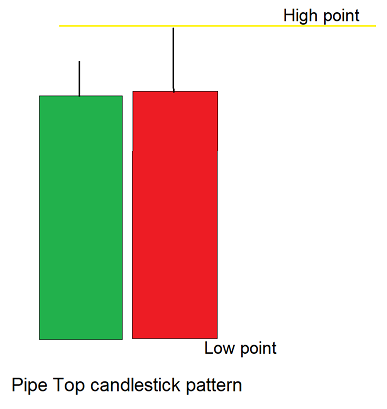

The Pipe Bottom Pattern is formed after a strong downtrend when two or more consecutive candlesticks (usually with long bodies) appear at or near the same low price level.

Structure

- In an ongoing downtrend, two or more tall bearish candlesticks are followed by similar-sized bullish candlesticks.

- The lows of both the candles are roughly equal, forming a “pipe” like structure.

- During the formation of the second candle, there is an increase in volume, indicating the potential bullish reversal. If the reversal candle forms on low volume, the pattern may be weaker or result in a pattern failure.

How to identify the Pipe Bottom chart pattern?

First, identify a security in a downtrend. Wait for the long bearish candle followed by the long bullish candle in the price chart. The pattern is confirmed when the bearish candle closes near the opening price of the previous candle, with only a slight difference.

When the following bullish candle is trading above the high of the previous candle, there is an increase in the volume on the buying side, validating the pattern reversal.

How to trade the Pipe Bottom chart pattern?

Buy signal:

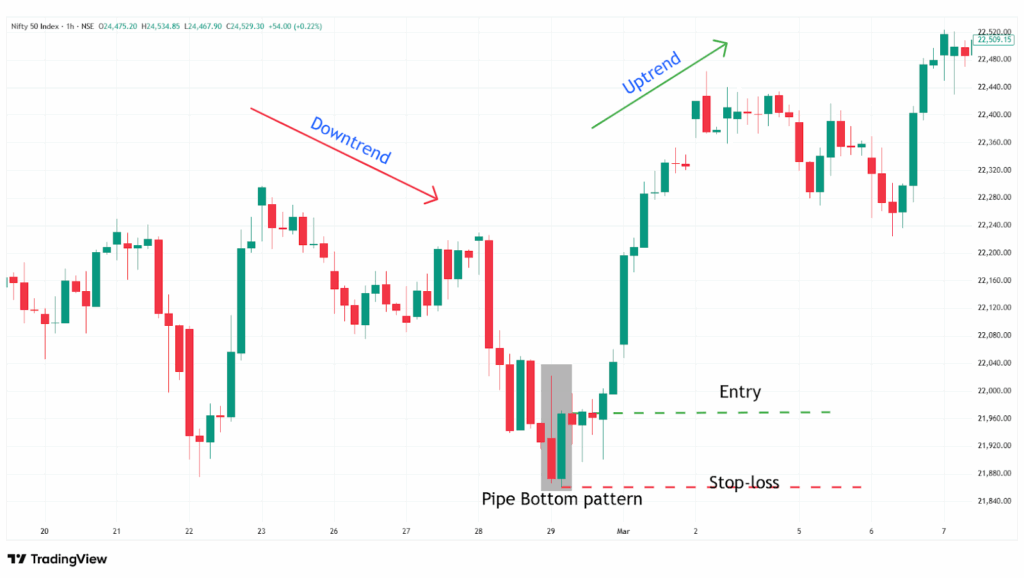

Entry:

- Enter a long position in the security at the close of the next candle formed after the pattern formation.

Stop-loss:

- Place the stop-loss at the low of the Pipe Bottom pattern.

Target:

- Set the target at the next resistance line of the price action.

- Or set your target based on your preferred risk-reward ratio with respect to your trading strategy.

Example:

The chart below shows an example of the “NIFTY 50” index at a 1-hour timeframe on 29th February 2025, and you can see the buy signal generated by the Pipe Bottom pattern.

What are the advantages of the Pipe Bottom chart pattern?

- The Pipe Bottom is one of the highly reliable bullish reversal patterns in technical analysis.

- The Pipe Bottom pattern acts as a strong support level after the breakout of the pattern.

- The Pipe Bottom pattern provides a clear entry, stop-loss, and target for everyone.

- The Pipe Bottom pattern is versatile across all timeframes and all other security markets, and as a single strategy, it can be applicable for all markets.

What are the disadvantages of the Pipe Bottom chart pattern?

- The Pipe Bottom pattern is dependent on the following candlestick to confirm the reversal, especially in low-volume market conditions, in which the pattern fails to signal a reversal.

- By the time the Pipe Bottom pattern confirms, much of the move may have already happened, as breakouts can occur quickly and reverse just as fast.

- In the Pipe Bottom pattern, the entry is delayed, and stop-loss placement may be wider, giving a higher risk for a lower reward, affecting your risk management.

In Closing

In the article, we learned the Pipe Bottom chart pattern, its structure, how to identify the pattern, how to trade it, along with an example of a past pattern formed, its advantages, and disadvantages.

The Pipe Bottom pattern helps traders identify potential bullish reversals after an ongoing downtrend, offering clear entry and exit signals for everyone.

Your profitability depends on your approach to the trade, your risk management, and your mindset when you are holding the trade, as no indicator or tool is 100% accurate in financial markets across the world, and as the Pipe Bottom chart pattern’s efficiency and accuracy increase rapidly when it is combined with additional indicators or tools (RSI, MACD, or others).