In trading, candlestick patterns are one of the most widely used tools to analyze market sentiment and predict potential price reversals. They reflect the ongoing battle between buyers and sellers, offering traders valuable insights into trend strength, uncertainty, or possible shifts in momentum.

In this article, we will discuss the Gravestone Doji Candlestick Patterns, their structure, the psychological pattern behind the candlestick formation, how to trade them with an example scenario, their advantages, and disadvantages.

What is the Gravestone Doji Candlestick Pattern?

The Gravestone Doji Candlestick is a single-candlestick pattern. It is an neutral to bearish trend reversal pattern, signalling uncertainty and a change in the market trend.

The Gravestone Doji Candlestick is formed when the strength of buyers and sellers is balanced, indicating no clear trend control.

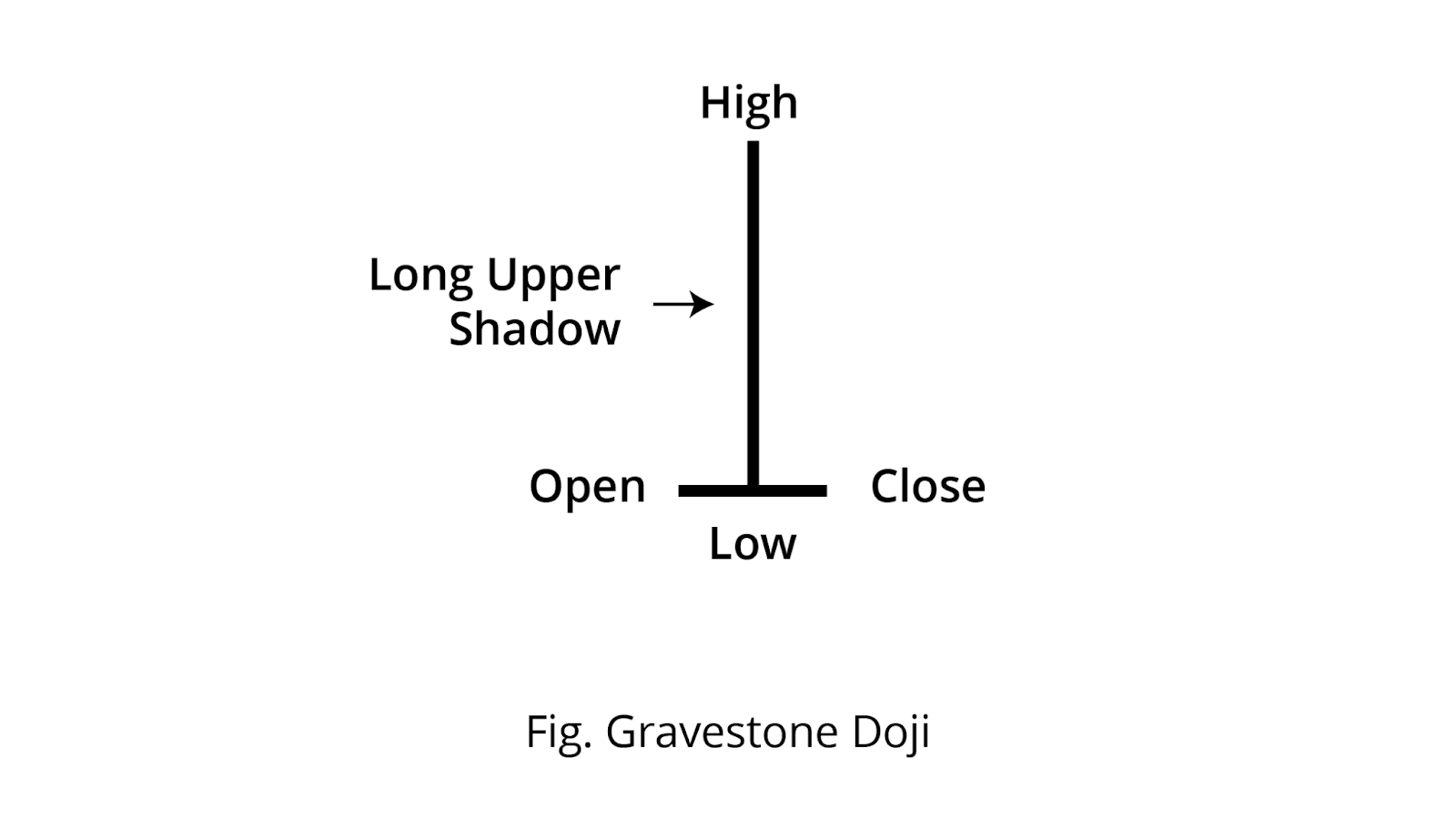

Structure

The Gravestone Doji is spotted at the top of the uptrend.

- A Gravestone Doji candle has an extremely small or non-existent real body, indicating that the opening and closing prices for the period are nearly identical.

- The long upper shadow/wick is typically at least twice the length of the body and has little to no lower shadow or wick.

The Gravestone Doji candlestick psychological pattern:

- Buyers push up: In the uptrend, buyers are dominant, driving the price to its high.

- Sellers step in: At the peak, sellers see an opportunity and aggressively push the price down, forming a long upper wick and creating a balance of pressure, and the price closes very near its opening, forming a small lower wick in some scenarios.

- Rejection of the high point: The long upper shadow shows the seller’s strength and aggressive pushing of the price back down.

- Closing near opening: The price closes near its opening, indicating sellers regained control over the trend.

How to trade a Doji candlestick pattern?

The Gravestone Doji candlestick is versatile across all the frames. In the lower timeframe, it is often spotted, making it hard to find the potential reversals.

To confirm the trade, use other tools and indicators with gravestone doji, by which you can avoid false signal trades.

Entry:

- If it next candle closes below the low of the Doji candle, you can enter a short position in the security.

Stop-loss:

- An ideal stop-loss is the high of the gravestone doji candlestick.

Target:

- The initial target is the next support line from the pattern formation or according to your risk-reward ratio.

- If there is any candlestick signalling a reversal after the confirmation. It is better to exit the existing position.

Example Scenario:

When you look at the image below, the chart of “Adani Enterprises Ltd” stock at a 1-hour timeframe on 18th June 2024. You can spot the Gravestone Doji candlestick followed by the confirmation on the next day with a bearish candlestick, indicating a downtrend ahead.

What are the advantages of the Gravestone Doji candlestick?

- If you have a short position in the trending market, the Gravestone Doji candlestick provides an early indication of uncertainty in the market.

- The structure displays the strength of sellers taking over in the end, giving you a clear understanding of the price action.

- The gravestone’s high often aligns with a potential resistance reference on retests; the low is not typically a resistance level.

What are the disadvantages of the Gravestone Doji candlestick?

- Gravestone Doji candlestick tells you a reversal may be coming, but it doesn’t indicate how strong the reversal will be or the trend direction.

- In sideways markets, efficiency and accuracy are low due to a lack of volume, which leads to a false signal.

- The single gravestone doji candlestick on its own is not strong enough to signal the trend reversal. After the confirmation, it is better to avoid unwanted risk.

In Closing

In the above article, we covered the Gravestone Doji Candlestick Patterns, how to trade, and their structure with an example, along with their candlestick psychological pattern, and its advantages and disadvantages.

The Gravestone Doji Candlestick Patterns adapt quickly to the market, signalling potential bearish reversals of the trend, making it more efficient, and it provides multiple opportunities for clear entry and exit, making it an accessible tool for beginners.

In the financial markets all over the world, no indicators or tools are 100% accurate. When the Gravestone Doji candlestick pattern is combined with additional indicators or tools like RSI, MACD, or others, the efficiency and accuracy are high, and with proper risk management and discipline, it can pave the path to profitability.