In Technical analysis, some candlestick patterns are rare to spot, and when spotted, they give a strong directional movement according to the type of the pattern, and one such pattern is the Bullish Stick Sandwich candlestick pattern. It is a powerful candlestick pattern signalling a strong reversal in the ongoing trend.

In this article, we will begin by defining what a Bullish Stick Sandwich is, its structure, the psychology behind the pattern, how to trade it with an example of a trade scenario, its advantages, and its disadvantages.

What is the Bullish Stick Sandwich candlestick pattern?

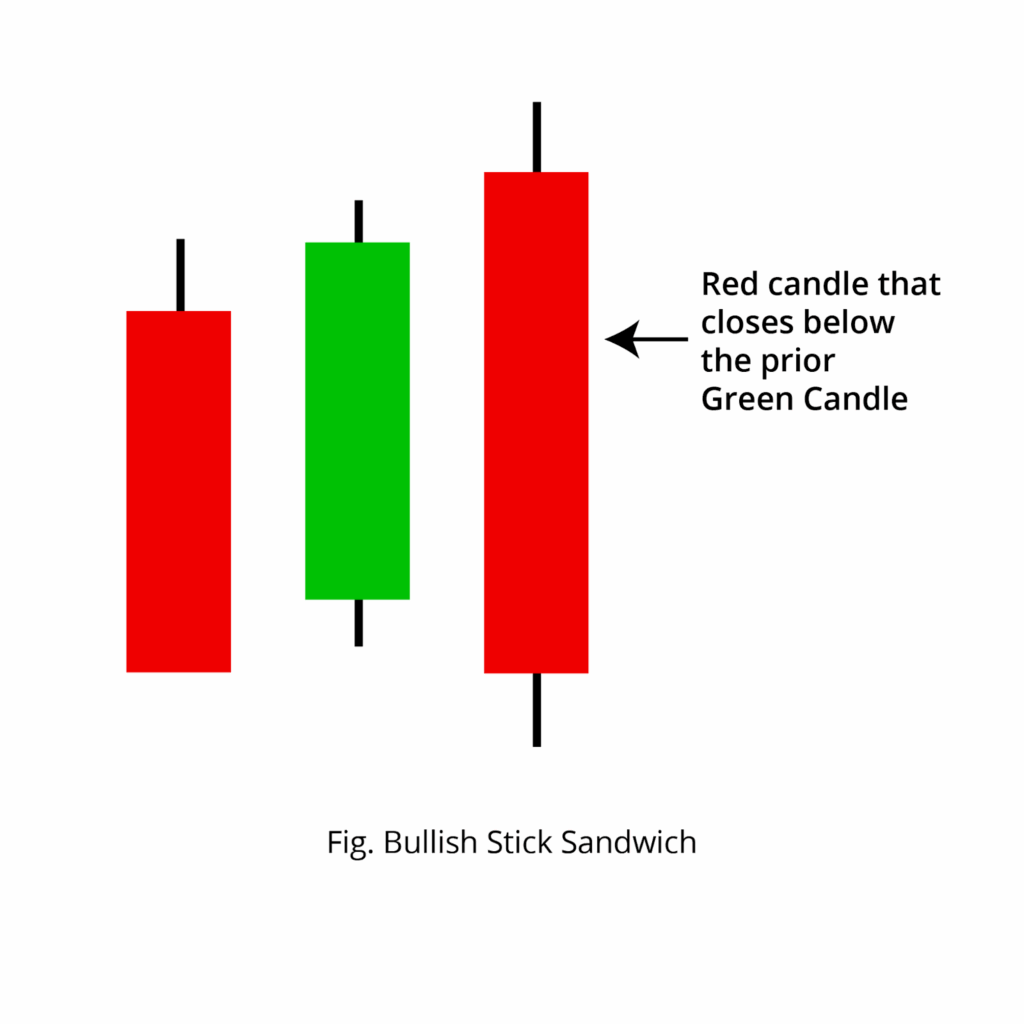

The Bullish Stick Sandwich candlestick pattern indicates potential bullish reversal in a downtrend and signals a change in market momentum from bearish to bullish, using a three-candlestick formation.

The term “Sandwich” refers to the arrangement of the candlesticks.

- In the pattern, the first and third candlesticks are bearish and have the same or very similar closing prices.

- The second candlestick is bullish and positioned between the first and third candlesticks, forming the “filling” of the sandwich.

Structure:

The Bullish Stick Sandwich is spotted at the bottom of the price chart.

- First Candlestick: A long bearish candlestick is formed, indicating the significant strength of the sellers to continue a downtrend.

- Second Candlestick: A bullish candlestick is formed that opens within or near the body of the first candlestick and closes higher, signalling buyers stepping in against the ongoing downtrend.

- Third Candlestick: A bearish candlestick forms, which closes at or near the same price as the first candlestick and below the prior green candle, creating a support level, while its open is typically near or slightly above the close of the second candlestick.

Psychology Behind the Bullish Stick Sandwich Candlestick Pattern:

- Bearish Candlestick: The security is in a downtrend, as sellers are dominant, driving the price to its low, resulting in a strong bearish candlestick formed, indicating the continuation of the downtrend ahead.

- Buyers step in: After continued selling pressure, buyers step in strongly with a candle that opens near the previous low and closes higher than the first candlestick, and then buyers step in to resist the sellers and push the price to its high, closing in a strong bullish candlestick

- Seller Step in: The third candlestick usually opens near or slightly above the middle candle’s close, and sellers push the price down, closing near the first candlestick’s close, which reinforces the support and signals buyers defending the level against downward pressure.

How to Trade the Bullish Stick Sandwich Pattern?

- Entry:

- Enter a long position in the security at the price above the high of the bullish stick sandwich candlestick pattern formed.

- Stop-loss:

- The stop loss for the long position can be placed at the low of the candlestick pattern formed.

- Target:

- The initial target is the next resistance line, or, according to your risk-reward ratio of 1:1, 1:2, or higher.

- In the price chart, if you spot any candlestick pattern formed signalling a reversal, you can book partial profits or trail the stop-loss.

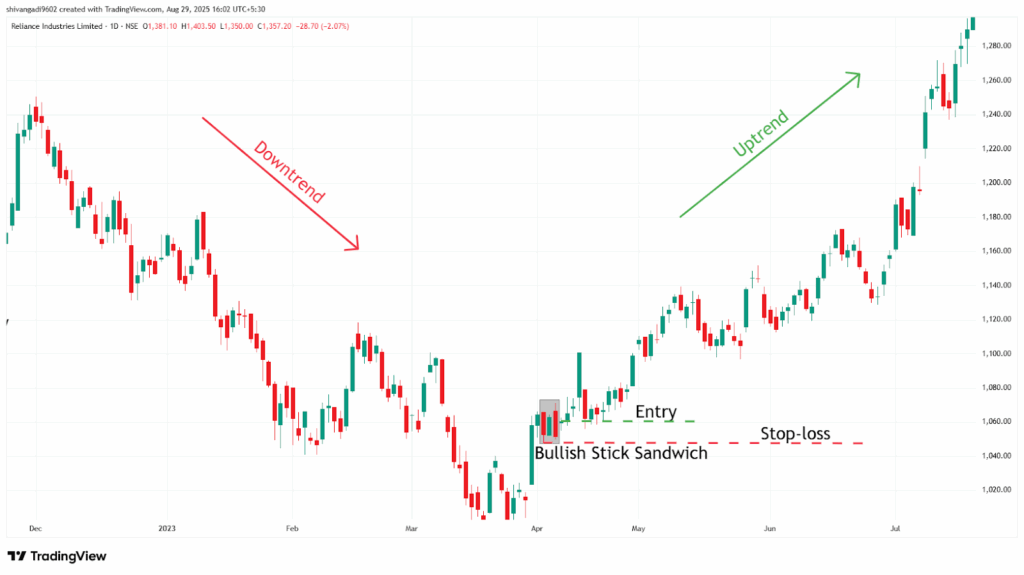

Example of trade scenario:

In the image below, you can look at the chart of “RIL Ltd” stock at a 1-day timeframe from 5th to 10th April 2023. You can spot the Bullish Stick Sandwich candlestick formed and signalling a buy, as it is a trend reversal.

What are the advantages of the Bullish Stick Sandwich candlestick pattern?

- The Bullish Stick Sandwich pattern is easy to identify and trade for beginners.

- The Bullish Stick Sandwich pattern provides a good risk-reward ratio, as you will be trading a minimal stop-loss.

- The Bullish Stick Sandwich pattern is versatile across all timeframes and security trading markets, as a single strategy applies to all markets.

- The Bullish Stick Sandwich pattern is not spotted often, but it helps beginners control overtrading.

What are the disadvantages of the Bullish Stick Sandwich candlestick pattern?

- In a sideways market, the Bullish Stick Sandwich can indicate false signals due to a lack of volume.

- The Bullish Stick Sandwich pattern signals the potential reversal, but does not describe the strength of the upcoming trend.

- The Bullish Stick Sandwich pattern lacks confirmation within the pattern, making it dependent on the following candlesticks.

- The Bullish Stick Sandwich pattern can be spotted after the news, making it hard to confirm the trade, and it involves higher risk.

In Closing:

In this article, we discussed the Bullish Stick Sandwich candlestick pattern, its structure, the psychology of the pattern, how to trade it, along with an example, and its advantages and disadvantages.

The Bullish Stick Sandwich candlestick is a powerful candlestick signalling the potential bullish trend reversal. At the same time, it offers limited opportunities for beginners with clear entry and exit signals. This makes it a relatively more reliable pattern to trade.

Your profitability depends on your approach to the trade, your risk management, and your mindset when you are holding the trade, as no indicator or tool is 100% accurate. As the Bullish Stick Sandwich candlestick pattern is combined with additional indicators or tools (RSI, MACD, or others), its efficiency and accuracy increase rapidly.