by FinGrad | Aug 11, 2025 | Credit Cards

Who doesn’t like the comfort of an airport or railway lounge? Many individuals who travel for business purposes are in a hurry. Chilling in the lounge can be a relaxing event. The comfortable space filled with food and people from all around the place sounds amazing...

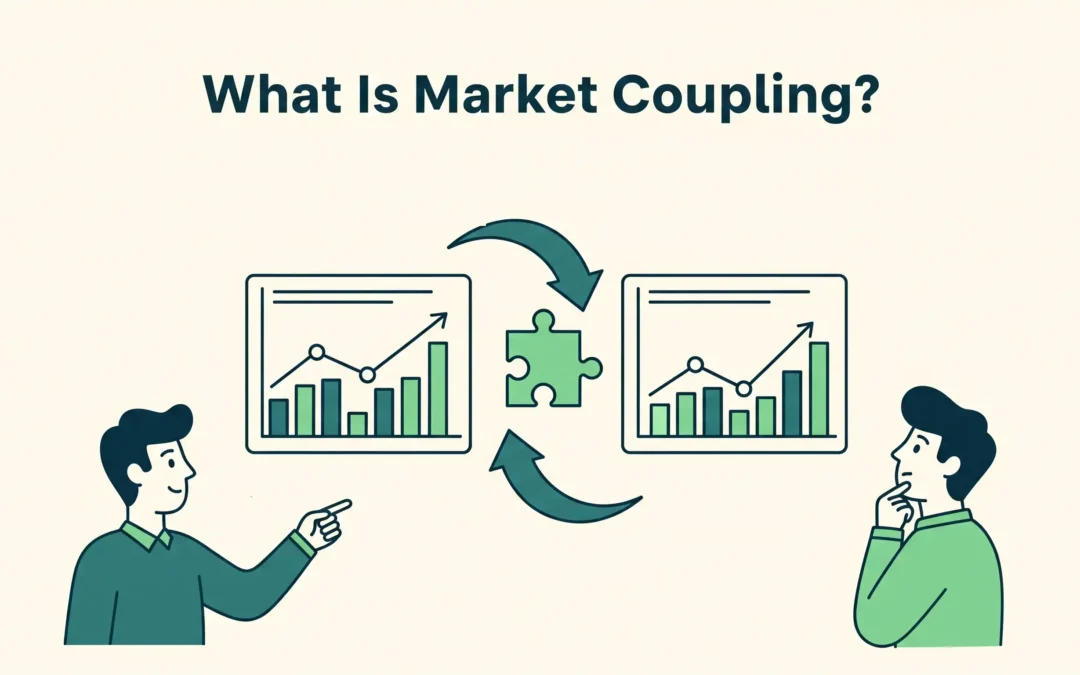

by FinGrad | Aug 11, 2025 | Articles

NSE and BSE are major stock exchanges in India with rapidly changing prices. However, market coupling relates specifically to power exchanges like IEX, PXIL, and HPX, which trade electricity, not stock exchanges. While all exchanges require electricity to...

by FinGrad | Aug 8, 2025 | Articles

People like investing to fulfil the main goal of growing their capital and building wealth in the long run. Real estate is one of the most trusted ways of investing. But not everyone can afford to buy a whole building, right? This is where fractional investing comes...

by FinGrad | Aug 7, 2025 | Articles

In an economy, all financial institution, such as banks, plays an important role. But there are other factors and intermediaries that are crucial for a better functioning of the economy. Shadow banking is one such non-banking facility that generates higher returns but...

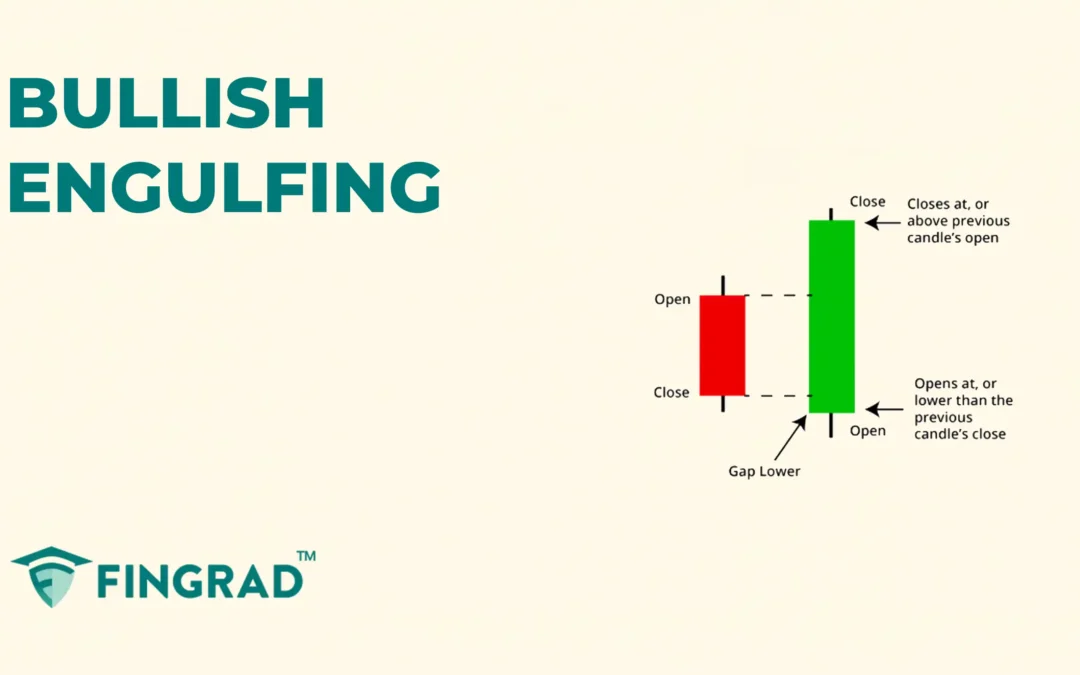

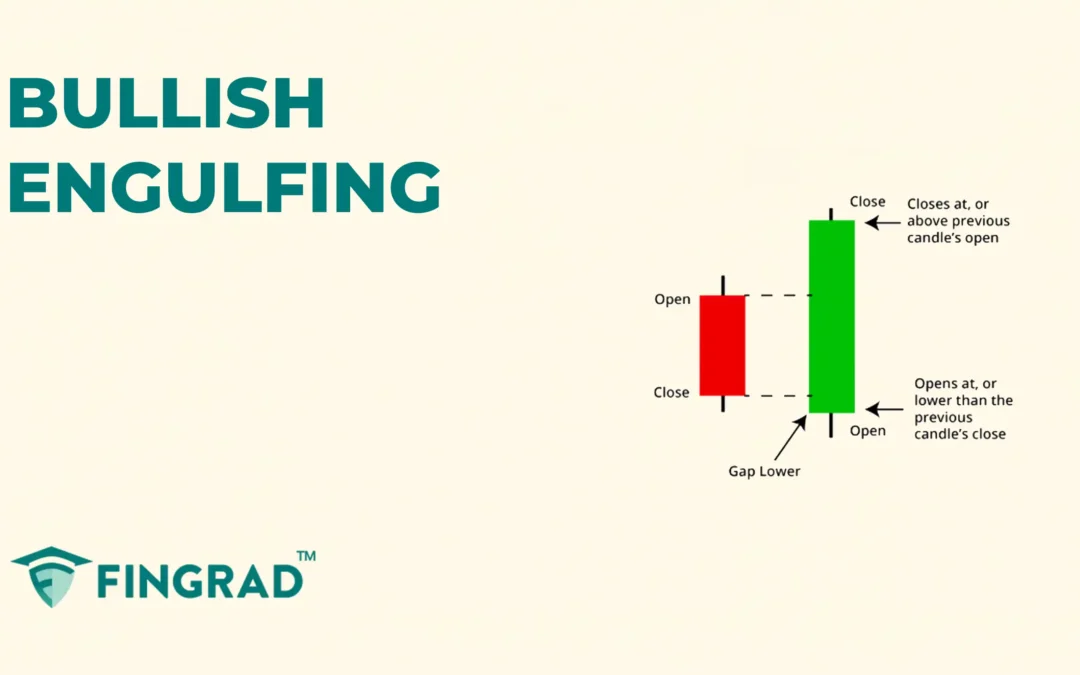

by FinGrad | Aug 7, 2025 | Technical Analysis

When you begin trading, you would want to avoid unnecessary risky trades. Then, one must start learning the candlestick patterns, as they are easy to identify and trade with a better understanding of price action, allowing for more efficient trading. They also help...