For new traders seeking easily identifiable and impactful trend reversal signals indicated within the candlestick price action, they must learn about candlestick patterns, as they have huge potential for trend reversal and are easy to spot and trade with minimal risk involvement. The Bearish Dark Cloud Cover candlestick pattern is an important tool to start with for beginners.

In this article, we will begin by defining what a Bearish Dark Cloud Cover is, its structure, its psychological pattern, and how to trade it with an example of a trade scenario, its advantages, and disadvantages

What is Bearish Dark Cloud Cover?

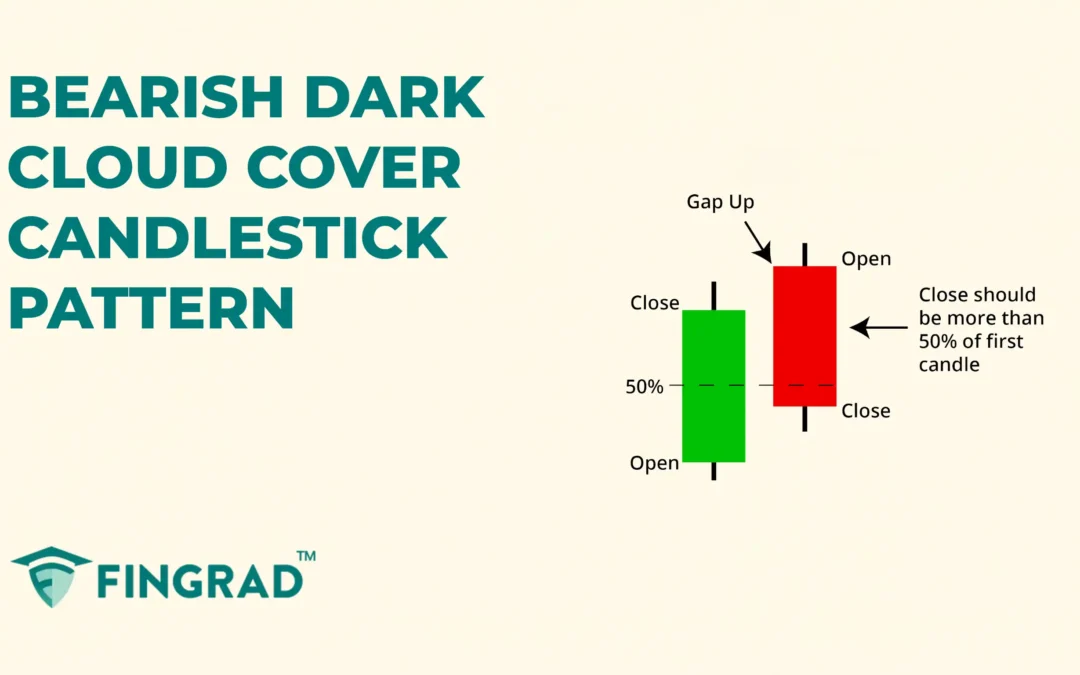

The Bearish Dark Cloud Cover candlestick pattern indicates a potential bearish reversal of the trend, and a change in market momentum from bullish to bearish, using a two-candlestick formation.

The term “Dark Cloud Cover” refers to the darkness overtaking daylight, by displaying the selling pressure on the security.

Structure:

The Bearish Dark Cloud is spotted at the top of the uptrend.

- First Candlestick: A long bullish candlestick indicates the significant strength of the buyers to continue an uptrend.

- Second Candlestick: A bearish candlestick that opens a gap up from the previous candlestick above the high and closes below the midpoint of the first candlestick, signaling a reversal from an uptrend to a downtrend.

The Bearish Dark Cloud Cover candlestick pattern psychology:

- Bullish Candlestick: At the current uptrend of the security, the buyers are dominating the trend, driving the price to its high, indicating further upward movement.

- Gap up Opening and Trend Reversal: The second candlestick opens above the high of the first candle, with a slight gap up above the high showing the strong buying interest, and then the sellers see an opportunity an aggressively stepin to push the price down to its low and closes below or at the midpoint of the first candlestick, indicating a change in the current trend, resulting in a strong bearish trend ahead.

Trade strategy of the Bearish Dark Cloud Cover?

After spotting the Bearish Dark Cloud Cover pattern at the top of an uptrend, it is recommended to wait for confirmation to avoid false signals and unnecessary risk.

The confirmed pattern formation suggests that traders enter a short position in a security.

- Entry:

- An entry in the security can be placed at the opening price of the next candle after the formation of the dark cloud cover candlestick pattern.

- Stop-loss:

- The stop loss for the trade can be placed at the high of the pattern formed.

- Target:

- The initial target is the next support line, or it can vary according to your risk-reward ratio, 1:1, 1:2, or higher.

- If there is any candlestick pattern formed signaling a reversal, you can plan an exit.

Example of trade scenario:In the image below, you can look at the chart of “VEDANTA Ltd” stock at a 4-hour timeframe, 21st and 22nd May 2024. You can see the sell signal generated by the Bearish Dark Cloud Cover candlestick, indicating the change in the uptrend.

The advantages of the Bearish Dark Cloud Cover pattern:

- The candlestick pattern is versatile across all time frames and is easy to identify and trade for everyone.

- It provides a strong indication of the trend reversal, the bearish momentum, as you can capture the entire downtrend.

- The candlestick pattern has a better risk-reward ratio due to a minimal stop-loss.

- The candlestick pattern is versatile across all security markets, giving an advantage in trading with the same strategy across financial markets.

What are the disadvantages of the Bearish Dark Cloud Cover pattern?

- The candlestick lacks confirmation within the pattern, making it dependent on the following candlestick.

- The candlestick may appear during short pullbacks in a strong uptrend; without a proper understanding of the pattern, you can enter a wrong trade.

- In sideways markets, due to a lack of volume, the candlestick pattern may result in a false signal.

In Closing

In this article, we have understood what Bearish Dark Cloud Cover is, its structure, its psychological aspects, and how to trade it with an example of a trade scenario, its advantages, and disadvantages.

The Bearish Dark Cloud Cover candlestick is a powerful candlestick signalling the potential bearish trend reversal. At the same time, it offers multiple opportunities for beginners with clear entry and exit signals, making it a more reliable pattern to trade.

No indicator or tool is 100% accurate in the Security markets. When the Bearish Dark Cloud Cover candlestick pattern is combined with additional indicators or tools, like RSI, MACD, or others, the efficiency and accuracy are high. Along with proper risk management, discipline, and back testing of the strategy, it can pave the path to profitability.