For traders seeking easily identifiable and impactful trend reversal signals. Then you must learn about the candlestick patterns, as they have a huge potential for trend reversal and are easy to spot and trade with minimal risk. The Bearish Engulfing candlestick pattern is an important and easy tool to start with.

In this article, we will begin by defining what a Bearish Engulfing is, its structure, the psychology of the candlestick, and how to trade it. Also, we will learn limitations, an example of a trade scenario, and the difference between a bearish and a bullish engulfing.

What is Bearish Engulfing Candlestick Pattern?

The Bearish Engulfing candlesticks pattern indicates the potential reversal in an uptrend and signals the change in the market momentum from bullish to bearish, using a two-candlestick formation.

The candlestick pattern displays that the buyers are slowly losing control over the trend and the sellers are aggressively taking control of the trend, signaling the shift from bullish to bearish momentum.

Structure:

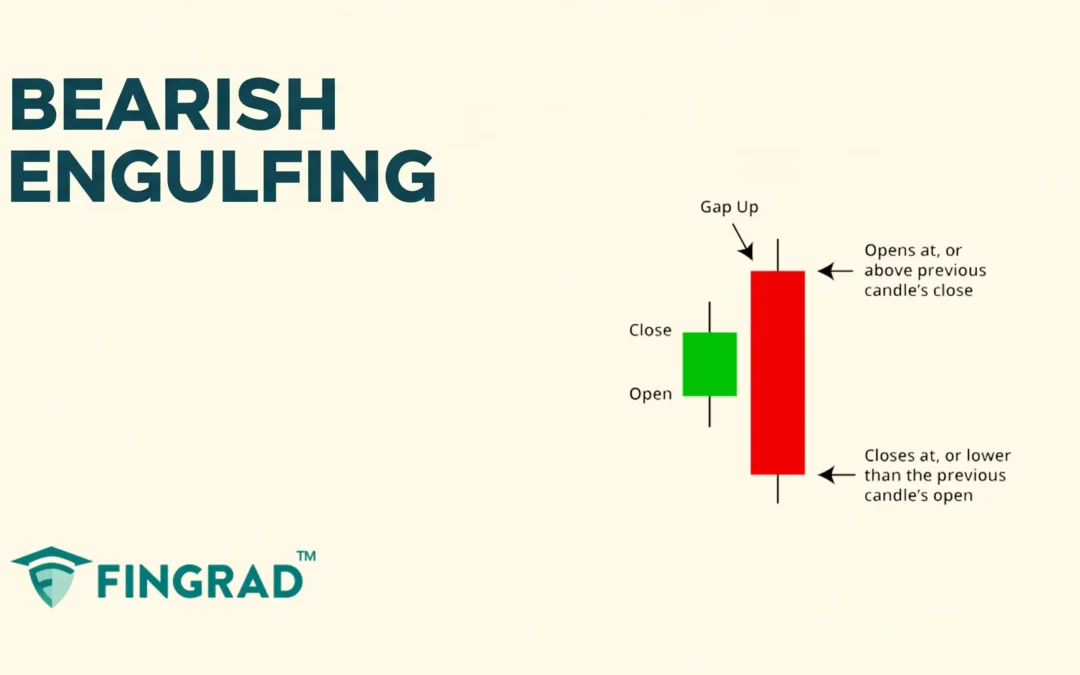

The Bearish Engulfing is spotted at the top of the price chart.

- First Candlestick: A small body bullish candlestick indicates the significant strength of the buyers to continue an uptrend.

- Second Candlestick: A large bearish candlestick that opens above the closing price and closes below the opening price of the first candlestick, signaling a reversal from an uptrend to a downtrend.

Psychology Behind the Bearish Engulfing Candlestick Pattern:

- Bullish Candlestick: At the current uptrend of the security, the buyers are driving the price to its high, indicating further upward movement.

- Sellers take control and Trend Reversal: The second candlestick opens above the closing price of the first candlestick as buyers are dominating the uptrend, and with a clear intention to push the price up.

Sellers aggressively push the price down at the start of the second candlestick, overwhelming buyers and forming a strong bearish candlestick. This indicates a change in the ongoing uptrend, with the second candlestick closing below the opening price of the first.

How to Trade the Bearish Engulfing?

It is recommended to wait for confirmation to avoid false signals and unnecessary risk.

- Entry

- As the following candlestick closes below the low of the second candlestick of the bearish engulfing pattern, enter the trade.

- Stop-loss

- Place the stop-loss at the high of the bearish engulfing pattern.

- Target

- Your initial target is the next support line.

- If there is any candlestick pattern formed signaling a reversal, you can plan an exit.

Example of trade scenario:

In the image below, you can look at the chart of “RIL Ltd” stock at a 1-hour timeframe on 12th and 15th July 2024. You can see the sell signal generated by the Bearish Engulfing candlestick as it is a trend reversal.

What are the limitations of Bearish Engulfing?

- In sideways markets, due to a lack of volume, the trend confirmation may not lead to a real trend reversal.

- The pattern does not provide built-in levels for targets.

- During the quarterly results, budget, for global economic news, the pattern may be inefficient due to high volatility.

Bearish Engulfing vs Bullish Engulfing

| Bearish Engulfing | Bullish Engulfing |

| 1. To identify the potential reversal of an uptrend. Signaling from a bullish to a bearish trend. | 1. To identify the potential reversal of a downtrend. Signaling from a bearish to a bullish trend. |

| 2. Market sentiment: Buyers are losing control over the trend, and sellers are taking over. | 2. Market sentiment: Sellers are losing control over the trend, and buyers are taking over. |

| 3. Implementation: Suggest that the trend is getting in control of the sellers and may reverse to a downtrend market. | 3. Implementation: Suggest that the trend is getting in control of the buyers and may reverse to an uptrend market. |

| 4. Used by: Traders looking for sell signals or to make a short position when the market is in an uptrend. | 4. Used by: Traders looking for buy signals or to make a long position when the market is in a downtrend. |

In Closing

In this article, we have understood what Bearish Engulfing is and how to trade it. Along with its limitations, an example of a trade scenario, and the difference between bearish and bullish engulfing.

Bearish Engulfing is an efficient strategy to identify the potential bearish reversal, especially when the markets are heading upward. At the same time, the Bearish Engulfing offers multiple opportunities for beginners with clear entry and exit signals and making it an accessible and reliable pattern to trade.

Across the financial markets all over the world, no indicator or tool is 100% accurate. When the Bearish Engulfing candlestick pattern is combined with additional indicators or tools, its efficiency and accuracy increase rapidly, and with proper risk management, discipline, and back testing of the strategy can pave the path to profitability.