In the world of technical analysis, candlestick patterns offer valuable insights into the price action and the sentiment of the buyers and sellers. In finding a potential bullish reversal, the five-candlestick formation is a powerful tool for ease of use and risk reduction. Among these, the Bullish Breakaway candlestick pattern stands out in helping traders to identify and trade.

In this article, we will discuss the Bullish Breakaway Pattern, its structure, the psychological pattern of candlesticks, how to trade the pattern with an example, and its advantages and disadvantages.

What is the Bullish Breakaway Candlestick Pattern?

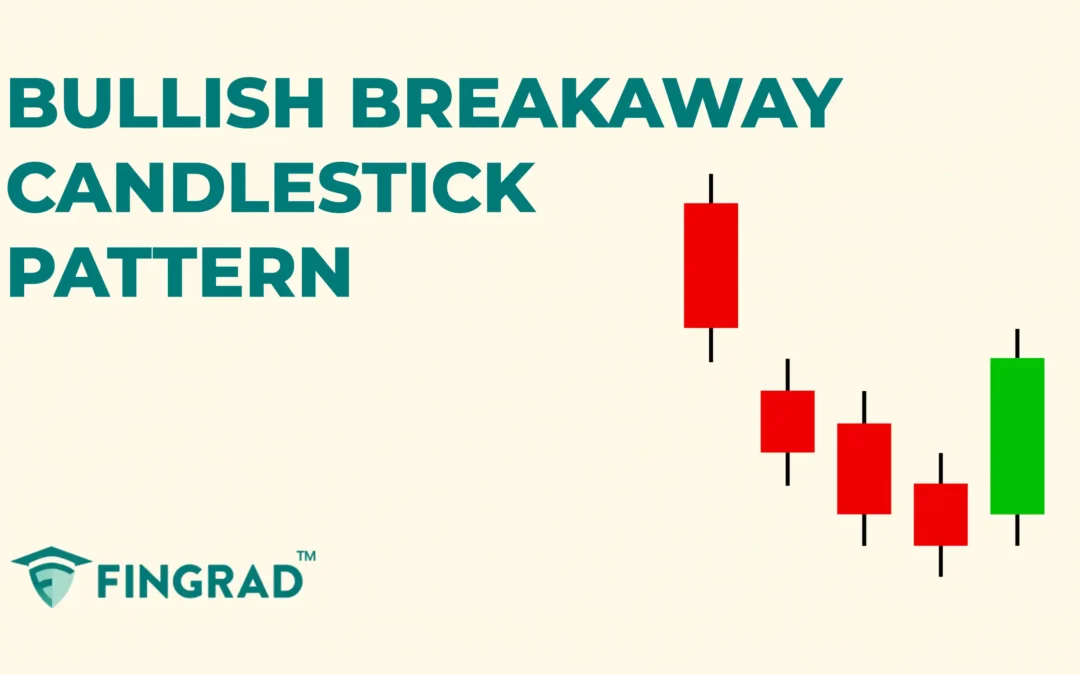

The Bullish Breakaway candlesticks pattern is a five-candlestick formation that indicates the potential bullish reversal from a downtrend to an uptrend.

These patterns suggest that the sellers are losing control slowly, and the buyers are taking over the trend. This results in a bullish trending market ahead.

Structure

The Bullish Breakaway candlestick pattern is spotted at the bottom of a downtrend.

- First candlestick: It is a strong bearish candlestick, signalling the continuation of the downtrend movement of the security.

- Second to Fourth candlestick: The weak consecutive bearish small-bodied candlesticks indicate a slow decrease in selling pressure.

- Fifth candlestick: It is a strong bullish candlestick that is formed, signalling a potential trend reversal from a downtrend to an uptrend.

The Bullish Breakaway candlestick pattern psychology

- First Four Candlesticks: The security is in a downtrend. In the first candlestick, the sellers are dominant, driving the price to its low, and forming a new lower low, indicating further downward movement. Following this, the next three smaller bearish candles, often gapping down, show sellers losing momentum.

- Buyers Step in and Trend Reversal: After the fourth candlestick, the price is at a significant low. The buyers see an opportunity and step in aggressively to drive the price higher, resulting in a long bullish candlestick signalling a strong upward-trending market ahead.

How to trade the Bullish Breakaway candlestick pattern?

The Bullish Breakaway candlestick patterns are versatile across all frames, and traders can plan for a long position in the security.

Wait for the confirmation to enter the trade to avoid false signal trades.

Entry:

- Plan for an entry when the candlestick following the pattern closes above the high of the fifth candle.

Stop-loss:

- The stop loss for the long position trade can be placed at the low of the pattern formed.

Target:

- An ideal target is the next resistance line.

- According to your risk management, your primary target can vary 1:1 to 1:2 based on your risk-reward ratio.

Example scenario:

In the image below, you can look at the chart of “ HCL Technologies Ltd” stock at a 1-hour timeframe from 25th January 2025, and you can see the buy signal generated by the Bullish Breakaway candlestick pattern.

What are the advantages of the Bullish Breakaway candlesticks pattern?

- It provides an early reversal signal to identify the optimal entry and exit points.

- It provides a strong momentum signal as buyers are taking control over the trend.

- As the pattern is not spotted often, it helps to reduce overtrading for beginners.

- The pattern low acts as a strong support level for the further price action of the security.

What are the disadvantages of the Bullish Breakaway candlesticks pattern?

- In a sideways market, due to a lack of volume, the pattern formed can result in a false signal.

- It identifies the potential reversal pattern, but does not describe the strength of the trend.

- Since it is not often spotted, it provides limited trading opportunities for traders, depending only on the bullish breakaway pattern.

- The pattern does not provide built-in confirmation. You will need to wait for the follow-up candlesticks to confirm the direction of the trend.

In Closing

In this article, we covered the Bullish Breakaway candlestick pattern, its structure, the psychology of the pattern, how to trade it, along with an example, and its advantages and disadvantages.

The Bullish Breakaway candlesticks pattern is a powerful five-candlestick formation signalling the potential bullish reversal from a downtrend to an uptrend of the security. Because it is not often spotted, it offers limited opportunities for beginners, helping them reduce overtrading and providing clear entry and exit signals and making it an accessible and reliable pattern to trade for everyone.

In the financial markets, the accuracy of tools and indicators is not 100%. When the Bullish Breakaway candlestick pattern is combined with additional indicators or tools( like RSI, MACD, Resistance and Support Levels), its efficiency and accuracy increase rapidly, and with proper risk management, discipline, and back testing of the strategy of the candlestick pattern, you can pave the path to profitability.