In technical analysis, chart patterns are essential tools that help traders understand price behaviour and predict future market movements. These formations often reveal whether a trend is likely to continue or reverse, giving traders clearer entry and exit points. One such widely recognised formation is the Bullish Flag pattern, which signals the continuation of an ongoing uptrend.

In this article, we will discuss the Bullish Flag Pattern, its structure, how to identify it, how to trade it with an example, its advantages, and its disadvantages.

What is the Bullish Flag Pattern?

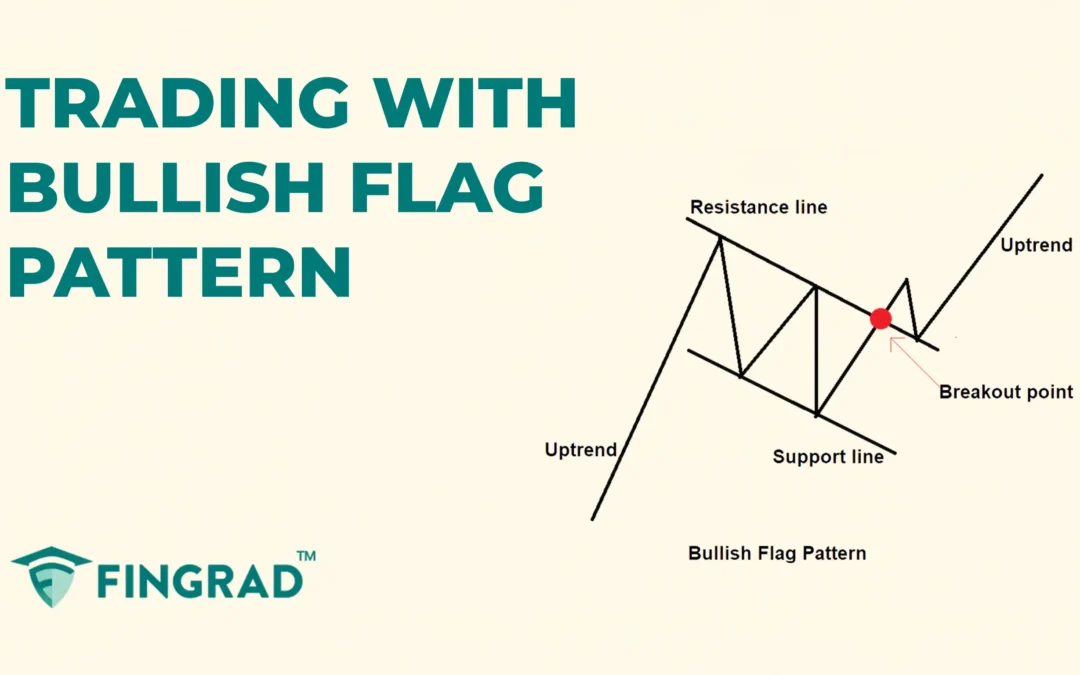

The Bullish Flag Pattern is a technical pattern that indicates a continuation pattern forms after a strong upward price move, followed by a short period of consolidation that slopes downward or sideways. The pattern can be formed over days, weeks, or even months, depending on price action.

Once this consolidation of the price is over, the price usually breaks out upward to continue a strong bullish trend.

Structure

The Bullish Flag Pattern is spotted in the middle of an uptrend.

- Flagpole: A sharp upward move of the price with strong bullish momentum and increased buying volume.

- Flag: It is a tight consolidation phase forming a downward or horizontal channel. It shows temporary consolidation, not reversal.

- Breakout: When a bullish candlestick breaks above the upper resistance trendline of the pattern, it indicates the continuation of the uptrend ahead.

How to identify the Bullish Flag Pattern?

Spot the security trading in a strong uptrend, look for the pullback or sideways channel following the rise at any timeframe, and as the price is consolidating within two parallel lines sloping downward or flat.

Wait for a breakout candlestick: A confirmed break above the resistance line is your signal to trade the security in an upward direction.

Calculate the target: Measure the height of the flagpole, and project that distance upward from the breakout point.

How to trade the Bullish Flag Pattern?

Entry:

- Enter a long position in the security when the candle breaks and closes above the flag of the pattern formed.

Stop-loss:

- Place the stop-loss below the most recent swing low or the bottom of the flagpole.

Target:

- Set the primary target based on the measured distance from the breakout point.

- In an ongoing trade, if you spot any candlestick or pattern signalling a bearish reversal, then book partial profit or trail your stop-loss.

Example:

In the image below, you can refer to the chart of the “ RIL & Co Ltd” stock at a 15-minute timeframe from 19th to 21st May 2025, and you can see the buy signal generated by the Bullish Flag pattern.

What are the advantages of the Bullish Flag Pattern?

- The Bullish Flag pattern provides a strong and reliable bullish continuation signal.

- The Bullish Flag pattern provides a clear entry, exit, and target to trade for everyone.

- The Bullish Flag pattern is versatile across all timeframes and all other security markets, as a single strategy can be applicable for all markets.

What are the disadvantages of the Bullish Flag pattern?

- For a strong breakout, the Bullish Flag pattern is dependent on the following volume on the buying side.

- The Bullish Flag pattern is hard to identify, especially in volatile markets or uncertain price action.

- In the Bullish Flag pattern without a volume spike on breakout, the signal can be weak or unreliable, resulting in a false trade.

In Closing

In this article, we covered the Bullish Flag pattern, its structure, how to identify the pattern, how to trade it, along with an example, its advantages, and disadvantages.

The Bullish Flag pattern is a powerful tool that signals the potential bullish continuation in the ongoing uptrend, and it indicates multiple opportunities for clear entry and exit signals.

Your profitability depends on your approach to the trade, your risk management, and your mindset when you are holding the trade, as no indicator or tool is 100% accurate, and when the Bullish Flag pattern is combined with additional indicators or tools (RSI, MACD, or others), its efficiency and accuracy increase rapidly.