When you begin trading or investing, you may not be able to enter all the potential trades due to various scenarios, a lack of confidence, or insufficient risk management. In other cases, you might be slow to react to opportunities. To identify potential candlestick patterns for re-entry, the Rising Window pattern has a huge impact in identifying such trend continuation.

In this article, we will understand what the Rising Window candlestick pattern is, its structure, and how to trade it. Along with the candlestick psychological pattern, an example of a trade scenario, and its advantages and disadvantages.

What is the Rising Window candlestick pattern?

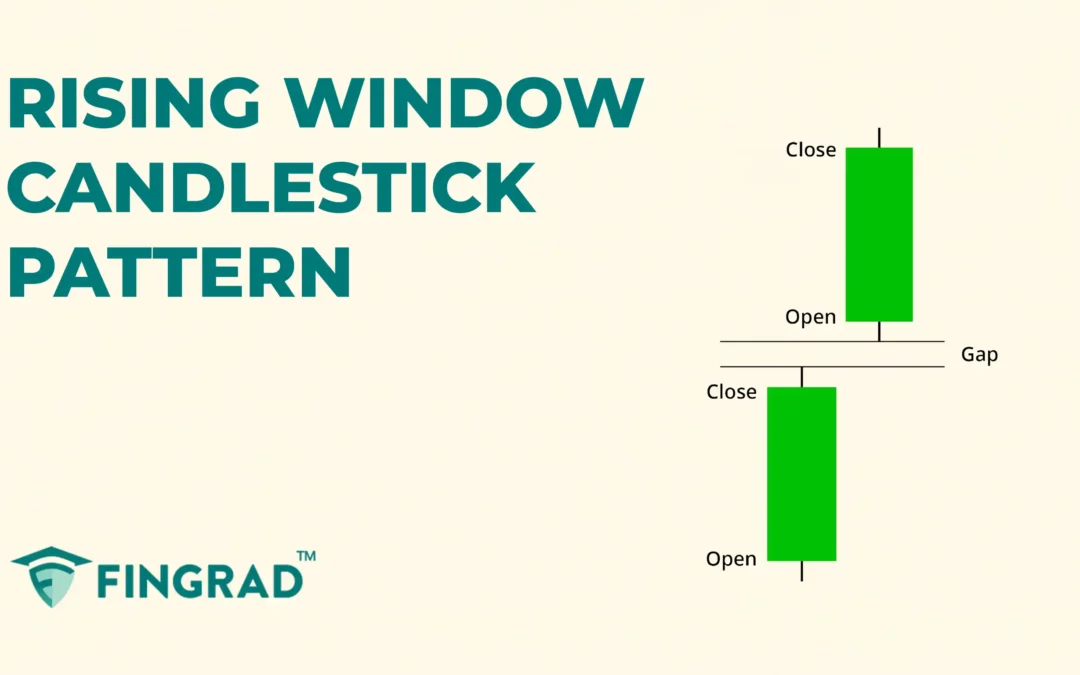

The Rising Window is a two-candlestick formation that signals a strong bullish trend continuation of the existing movement in an upward direction.

The term “Rising” signals a bullish move, and “Window” signals a gap-up in the price, indicating that buyers are in full control and pushing prices to higher levels, and providing valuable insight into the market. And it is simple, easy to understand, and beginner-friendly.

Structure:

It is spotted in the middle of an uptrend.

- First candlestick: A bullish candlestick, indicating that buyers are in control of the trend.

- Price Gap-up: There’s a gap up between the first and second candlesticks.

The gap displays the buying demand for the security.

- Second candlestick: A strong bullish candlestick that opens above the high of the first candlestick.

Psychology Behind the Pattern:

- Buyers push up: The candlestick pattern is spotted within a current uptrend. The first candlestick is bullish, displaying the strength of the buyers and controlling the trend.

- Gap-up: There is a visible “gap” displayed between the candlesticks, where the second candlestick opens above the high of the first candlestick. “The gaps between prices act as a strong support level in the Rising Window pattern.

- Closing near high: As buyers are aggressively pushing the price up, sellers try to push it back down, but buyers strongly reject and push it back up, displaying the strength of the buyer over the trend, and signaling that an uptrend continues.

How to trade it?

While trading using candlesticks, it is always recommended to wait for confirmation. For the Rising Window pattern, the third candlestick must be bullish.

Entry:

- An entry to the long position can be placed at the close of the next candle after the formation of the pattern.

Stop-loss:

- The stop loss for the trade can be placed at the low of the pattern formed.

Target:

- An ideal target is the next resistance line.

- The target for the trade can be placed at the low of the pattern formed.

- If you spot a candlestick formation signaling a potential reversal, you can plan for an exit.

Example:

In the image below, you can look at the chart of “HCL Technologies Ltd” stock at a 15-minute timeframe on 5th and 6th November 2024. You can see the buy signal generated using the Rising Window candlestick, as it is a trend continuation candlestick.

What are the advantages of the Rising Window candlestick?

- It provides a strong indication of the continuation of an uptrend.

- It is easy to identify and trade for both beginners and experienced traders.

- The gap-up levels act as strong support for the ongoing trend.

- It is versatile across all timeframes.

What are the disadvantages of the Rising Window candlestick?

- During quarterly results, global economic news, or other events, due to high volatility, it lacks efficiency and accuracy.

- It is hard to capture the entire trend, as a large portion of the uptrend is already over.

- When you are trading solely on the rising window candlestick is risky, affecting your risk-reward ratio.

- In a sideways market, due to a lack of volume, it often generates a false signal to ends up pushing the price up.

In Closing:

In this article, we covered the Rising Window candlestick pattern, its structure, how to trade it, with the candlestick psychological pattern, an example of a trade scenario, and its advantages and disadvantages.

In the end, the Rising Window is a powerful bullish candlestick leading the price action and indicating the continuation of an uptrend, which makes it more efficient, and with proper risk management, discipline can pave the path to profitability. The Rising Window Pattern indicates multiple opportunities for clear entry and exit signals, making it an accessible tool for beginners.

No indicator or tool is 100% accurate in the financial market across the world. When combined with additional indicators or tools like RSI, Pivot Point, or others, the efficiency and accuracy are high.