When you start trading or investing, you will want to identify the potential reversal with a quick movement after the confirmation, which is easy to spot, and trade with minimal risk for short-term trades. Then, the Three Black Crows candlesticks pattern you should know, as they have a huge impact in identifying trend continuation and potential reversal.

A three-candlestick is a powerful tool that provides you with a clear understanding of finding optimal entry and exit points.

In this article, we will start with what the Three Black Crows Pattern is, its structure, and how to trade it. Along with its limitations, an example of a trade scenario, and the difference between the Three White Soldiers vs. the Three Black Crows.

What is the Three Black Crows Pattern?

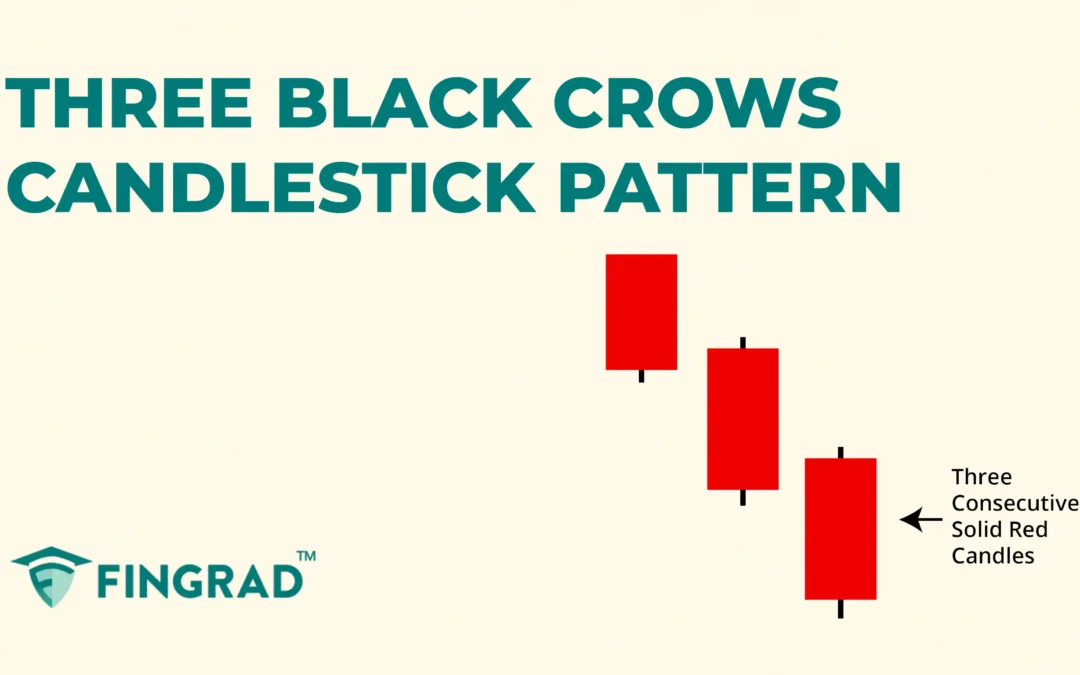

The three black crows pattern refers to a bearish reversal pattern that consists of three consecutive long-bodied bearish candlesticks. To identify a potential reversal in an uptrend.

Structure:

It is spotted at the top of the uptrend and signals the potential reversal from a bullish to a bearish trend.

- First Candle: A strong bearish candlestick that opens within or near the previous day’s candle and closes near its low, indicating strong selling pressure initiating the reversal.

- Second Candle: Another strong bearish candlestick that opens within the body of the first candle and closes near its low, further confirming strong selling pressure.

- Third Candle: The last strong bearish candlestick that opens within the body of the second candle and closes near its low, reinforcing the strong shift in momentum from bullish to bearish, and confirming the bearish reversal.

Psychology Behind the Three Black Crows Candlestick Pattern:

The three black crows candlestick pattern reveals a psychological shift in the market from optimism to pessimism. After a prior uptrend, the first strong bearish candle shakes the confidence of buyers, suggesting that sellers are starting to dominate.

As the next two bearish candles appear, traders watching the market interpret this series as confirmation that buying interest is fading and control is shifting to the bears.

This consecutive pattern of selling pressures causes more participants to exit long positions or even initiate shorts, reinforcing the increasingly negative sentiment and fueling further downward momentum.

How to trade the three black crow patterns?

After spotting the three black crows candlestick at the top of an uptrend, plan for a short entry as described below.

When trading with candlestick patterns, it is recommended to wait for the confirmation candlestick.

For the three black crows candlestick pattern, the fourth candlestick is the trend confirmation candlestick.

- Entry:

- Enter the trade when the candlestick closes below the low of the third bearish candlestick.

- Stop-loss:

- The stop loss for the short position can be the high of the three black crows pattern formed.

- Target:

- The target for the trade can be based on your risk-to-reward ratio.

- Or you can consider the initial target is the next support line from where the price can bounce back.

- If there is any candlestick signaling a reversal after the confirmation. It is better to take home some profit.

Example of trade scenario:

In the image below, you can look at the chart of “Adani Enterprises Ltd” stock at a 1-hour timeframe on 13th February 2025. You can see the sell signal generated using the three black crows candlestick, as it is a trend reversal.

Three White Soldiers vs. the Three Black Crows

| Three White Soldiers | Three Black Crows |

| 1. To identify the potential Bullish reversal from a downtrend to an uptrend. | 1. To identify the potential Bearish reversal from an uptrend to a downtrend. |

| 2. Structure: Three long-bodied bullish candlestick patterns. | 2. Structure: Three long-bodied bearish candlestick patterns. |

| 3. Implementation: Suggest that the trend is getting in control of the buyers and may reverse to an uptrend. | 3. Implementation: Suggest that the trend is getting in control of the sellers and may reverse to a downtrend. |

| 4. Volume: High volume reinforces a bullish reversal. | 4. Volume: High volume reinforces a bearish reversal. |

| 5. Used by: Traders looking for buy signals or to make a long position when the market is in a downtrend. | 5. Used by: Traders looking for sell signals or to make a short position when the market is in an uptrend. |

In Closing

In this article, we have understood what the three black crows pattern is and how to trade it. Along with its limitations, an example of a trade scenario, and the difference between the Three White Soldiers vs. the Three Black Crows.

Across the financial markets worldwide, no strategy or tool is 100% accurate. When the strategy is backtested with other tools and indicators(RSI, MACD, resistance, and support levels), the accuracy and understanding of the market increase rapidly.

Three Black Crows is an efficient strategy to identify the potential bearish reversal and is a strong visual indicator of bearish momentum in trending markets, especially in a downtrend market, and it provides multiple opportunities for clear entry and exit signals, making it an accessible and reliable tool for beginners.