Candlesticks display valuable insight into the market to identify potential trend reversals in price action and trade the security with an effective risk-reward ratio using candlestick patterns, tools, or other indicators. The Three Falling Method pattern is one among those highly efficient and reliable candlestick patterns, which signals the continuation of bearish trend using the candlestick pattern.

In this article, we will understand the Three Falling Method candlestick pattern, its structure, and the psychology behind the pattern. We will then cover an example scenario to learn how to trade with the pattern, along with its advantages and disadvantages.

What is the Three Falling Method Candlesticks Pattern?

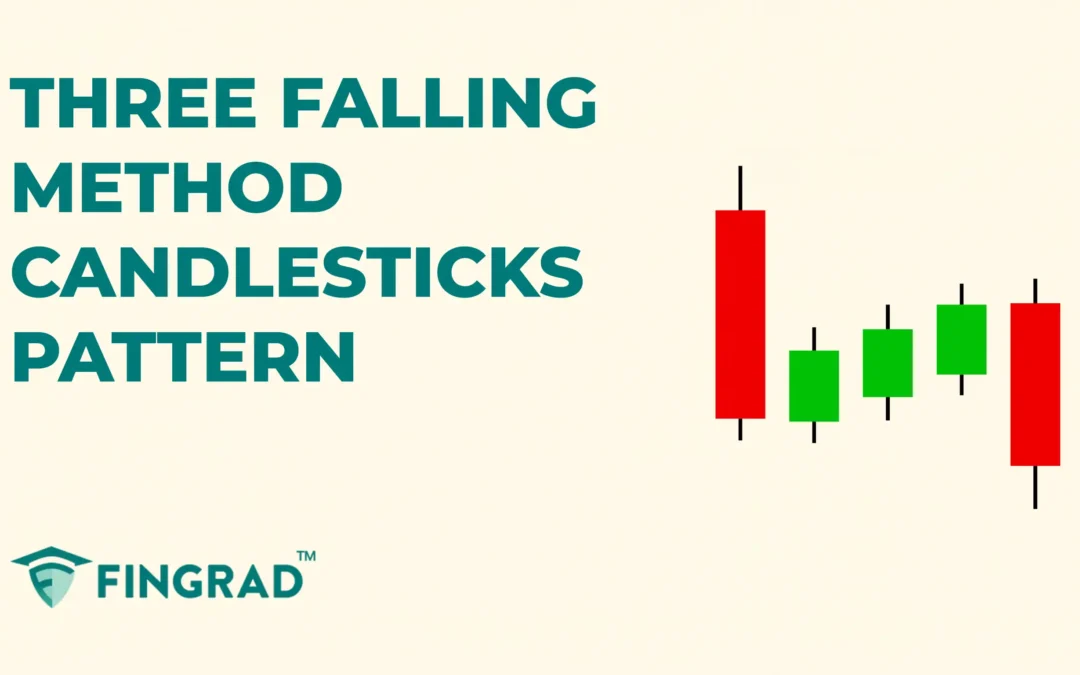

The Three Falling Method candlesticks pattern is a five-candle formation indicating the continuation of the bearish momentum.

As buyers attempt to push the price up but fail to overpower the sellers, sellers regain control over the trend again.

Structure

It is spotted in the middle of the current downtrend.

- First Candle: A strong bearish candlestick is formed, displaying the strength of sellers and a continuation of a downtrend.

- Second to Fourth Candle: They are the three small-bodied bullish or neutral candles, indicating a change in momentum and a loss in ongoing momentum.

- Fifth Candle: A strong bearish candlestick that closes below all three small bullish or indecision candlesticks, confirming the continuation of the downtrend.

What is the Psychology Behind the Three Falling Method Pattern?

- Sellers push down: The security is trading in a downtrend, sellers are dominant, driving the price to its low.

- Buyers step in: As selling pressure decreases, buyers begin to step into the security due to a lack of volume or confidence in the bullish reversal, resulting in a three small-bodied bearish candlesticks formation as buyers try to change the trend of the security.

- Strong Bearish Close and Trend Continuation: After the three bullish candlesticks, the sellers step in aggressively and start pushing the price down. The fifth candlestick is a strong bearish candlestick that closes below all four candlesticks, indicating selling pressure and sellers’ control over the trend, followed by a downtrend.

How to trade the Three Falling Method Pattern?

The Three Falling Method candlestick is versatile across all frames.

Entry:

- Enter the short position at the open price of the next candle after the formation of the three-falling-method pattern.

Stop-loss:

- The stop loss for the short trade can be placed at the high of the pattern formation.

Target:

- The primary target is the next support line.

- The target for the trade can also be placed according to your risk-to-reward ratio.

- If candlestick patterns are formed, signaling a reversal after the confirmation. Book profit or trail the stop-loss accordingly.

Example Scenario:

In the image below, you can look at the chart of “TCS Ltd” stock at a 1-hour timeframe on 13th February 2025. You can see the sell signal generated using the Three Falling Method candlestick pattern, as it is a trend continuation candlestick.

What are the advantages of the Three Falling Method Candlestick Pattern?

- The Three Falling Method candlestick pattern is easy to identify and trade.

- The Three Falling Method pattern signals the potential entries, helping you place stop-losses and adjust profit targets on long trades.

- The candlestick pattern provides a good risk-reward as the stop-loss is minimal, and for further price action, the first candlestick low acts as a strong resistance level.

- The Three Falling Method candlestick pattern is confirmed within the pattern, as it is not dependent on the following candlestick.

What are the disadvantages of the Three Falling Method Candlestick Pattern?

- During global economic news, quarterly results, or other events, due to high volatility, the candlestick pattern lacks efficiency and accuracy.

- It is not possible to capture the entire trend, as a large portion of the downtrend is already over.

- The small bearish candlesticks in the middle of the pattern can indicate a bullish pullback or reversal, leading to a false signal.

- For the continuation of the downtrend, the pattern requires high volume in the downtrend direction, or the formed pattern may result in a false signal.

In Closing

In the above article, we covered the Three Falling Method candlestick pattern, its structure, how to trade it, with the candlestick psychological pattern, an example of a trade scenario, and its advantages and disadvantages.

The Three Falling Method is a powerful five-candlestick formation that signals the continuation of the ongoing downtrend and leads the price action, making it more efficient. With proper risk management, discipline can pave the path to profitability, and the Three Falling Method candlestick pattern indicates multiple opportunities for clear entry and exit signals.

Across the world in all security trading markets, no indicator or tool is 100% accurate. When the three falling method pattern is combined with additional indicators or tools like RSI, MACD, or others, the efficiency and accuracy are improved.