When you start trading it’s hard to control your emotions on overtrading, then you must start to trade using the candlestick pattern which are rare to spotted, as it helps you to reduce the number of trades in a single day and over some time you become better at trading and controlling your emotions, one among such pattern is a Bearish Mat Hold candlestick pattern.

In this article, we will explore the Bearish Mat Hold candlestick pattern, its structure, the psychology behind the pattern, how to trade it with an example of a previous appearance in the Indian security market, its advantages, and disadvantages.

What is the Bearish Mat Hold candlesticks pattern?

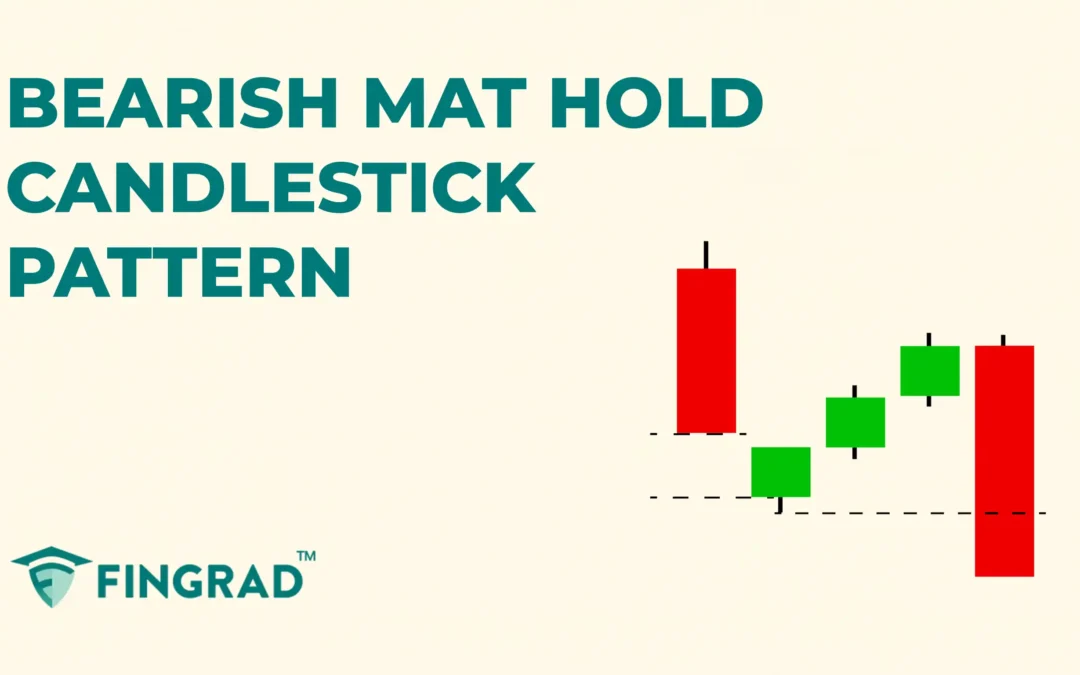

The Bearish Mat Hold candlestick pattern is a powerful five-candlestick formation indicating the continuation of the current downtrend.

It displays the temporary pause or pullback in price before the downtrend continues, where buyers step in and try to change the direction of the trend, but eventually, sellers take over.

Structure

The Bearish Mat Hold candlestick pattern is spotted in the middle of the ongoing downtrend.

- First Candlestick: A strong bearish candlestick is formed, displaying the strength of the sellers and indicating the continuation of the ongoing trend.

- Second to Fourth Candlestick: The constructive bullish candlesticks are formed, with a small gap down opening from the first candlestick, which closes bullish within the opening price of the first candle, displaying a minor correction, and buyers slowly trying to change the current trend.

- Fifth Candlestick: A strong bearish candlestick is formed, opens around the fourth candlestick, and closes below all four candlesticks, displaying the seller’s strength and signalling the strong downtrend ahead.

Psychology Behind the Bearish Mat Hold Candlestick Pattern

- Bearish Candlestick: The security is trading in a downtrend, and sellers are dominant, driving the price to its low.

- Buyers step in: As the second candlestick opens with a small gap down, and buyers see an opportunity and step in to drive the price to its high, resulting in a three small-bodied bullish candlestick formation as buyers try to change the trend of the security.

- Strong Bearish Close and Trend Continuation: After the three bullish candlesticks, the sellers step in aggressively and push the price down. The fifth candlestick is a strong bearish candlestick that closes below all four previous candlesticks, displaying selling pressure, and sellers take control of the ongoing trend, followed by a strong downtrend.

How to trade the Bearish Mat Hold Pattern?

The Bearish Mat Hold candlestick pattern is versatile across all securities markets and across all timeframes.

Entry:

- Enter the trade on the next bearish candlestick after closing below the low of the fifth candlestick.

Stop-loss:

- An ideal stop-loss is the high of the first candlestick of the Bearish Mat Hold candlesticks pattern.

Target:

- The primary target is the next support line.

- Or the target for the short position trade can be based on your risk-to-reward ratio.

Example Scenario:

In the image below, you can see the chart of “SBI Ltd” stock at a 1-hour timeframe from 16th to 17th February 2023. You can see the sell signal generated using the Bearish Mat Hold candlestick pattern, as it is a trend continuation candlestick.

What are the advantages of the Bearish Mat Hold candlestick pattern?

- The Bearish Mat Hold candlestick pattern is confirmed within the pattern, as it is not dependent on the following candlestick.

- The Bearish Mat Hold is versatile across all security markets, as a single strategy applies to all markets.

- The Bearish Mat Hold candlestick is a powerful and provides a clear signal for the continuation of a downtrend, as it is a five-candlestick pattern.

- The high of the first candlestick acts as a strong resistance level for further action for the security.

What are the disadvantages of the Bearish Mat Hold candlestick pattern?

- During global economic news, quarterly results, or other events, due to high volatility, the Bearish Mat Hold candlestick pattern is inefficient.

- It is not possible to capture the entire trend, as a portion of the downtrend has already been completed.

- For the continuation of the ongoing downtrend, the pattern requires high volume in the downtrend direction, or the formed pattern may result in a false signal.

In Closing

In the above article, we covered the Bearish Mat Hold candlestick pattern, its structure, how to trade it, with the candlestick psychological pattern, an example of a trade scenario, and its advantages and disadvantages.

The Bearish Mat Hold is a powerful five-candlestick formation that signals the continuation of the ongoing downtrend and leads the price action, making it more efficient. With proper risk management, discipline can pave the path to profitability, and the Bearish Mat Hold candlestick pattern indicates limited opportunities as it is rare to spot, and when spotted, it provides clear entry and exit signals.

Across the world in all security trading markets, no indicator or tool is 100% accurate, and when the Bearish Mat Hold candlestick pattern is combined with additional indicators or tools as RSI, MACD, or others, the efficiency and accuracy are improved.