In trading or investing, identifying highly efficient, accurate, and low-risk candlestick patterns is hard, not impossible. The Upside Thrust is one such pattern. For beginners, it is easy to spot and offers a very low probability of trade failure.

In this article, we will understand what the upside thrust is, its structure, the psychology of the pattern, how to trade it with an example, and its advantages and disadvantages.

What is the Upside Thrust Candlestick Pattern

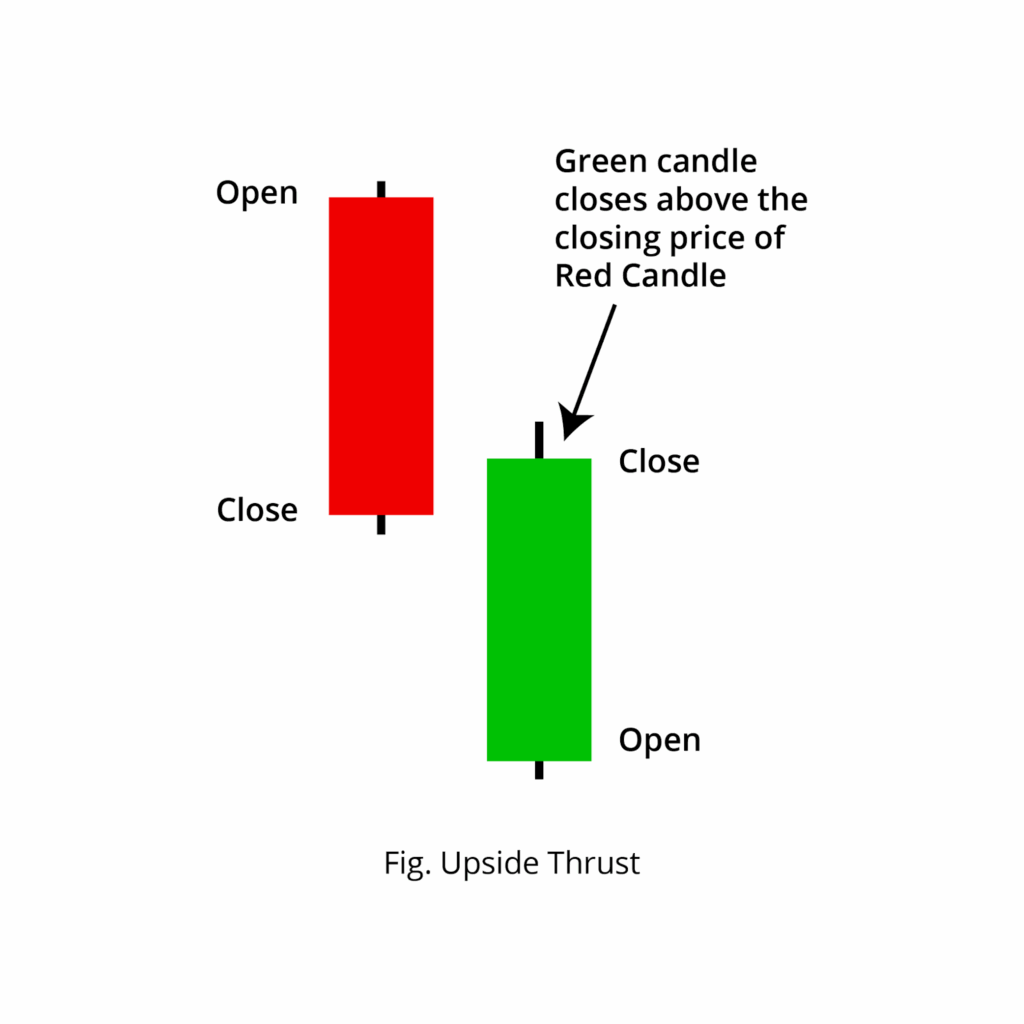

The Upside Thrust Candlestick is a two-candlestick formation that signals a potential bullish continuation or weakening of the downtrend, providing valuable insight into buyer strength during a downtrend.

When buyers step in strongly against the downtrend, the Upside Thrust is formed, providing valuable insight into the market, and is simple, easy to understand, and beginner-friendly.

Structure Of Upside Thrust Candlestick Pattern

It is spotted near the bottom of a downtrend.

- First candlestick: A bearish candlestick is formed, signalling the strength of the sellers and are in control of the downtrend and its continuation.

- Second candlestick (Thrust Candlestick): Second candlestick (Thrust Candlestick): A bullish candlestick that opens below the low of the first candle and closes within the body of the first candlestick but below its midpoint. Sometimes, a lower wick forms, representing a last effort by sellers to push the price down.

Psychological behind the pattern

- Selling pressure: Sellers are initially dominant, driving the price to its lower low.

- Buyers push up: In a downtrend, when the price is at its low, buyers see an opportunity and start aggressively pushing the price up.

- Rejection of the low: For the last time, sellers tried to push the price down, but buyers strongly rejected and aggressively pushed it back up, forming a lower wick.

- Closes within the body: When the candlestick closes inside the body of the first candle but below its midpoint, it suggests a reduction in selling pressure and the possibility of buyers regaining control, signaling a potential bullish continuation.

Strategy to trade the Upside Thrust Candlestick pattern?

While trading using candlestick patterns, it is always recommended to wait for confirmation to avoid unnecessary risk factors. For the Upside Thrust pattern, the third candlestick must be bullish.

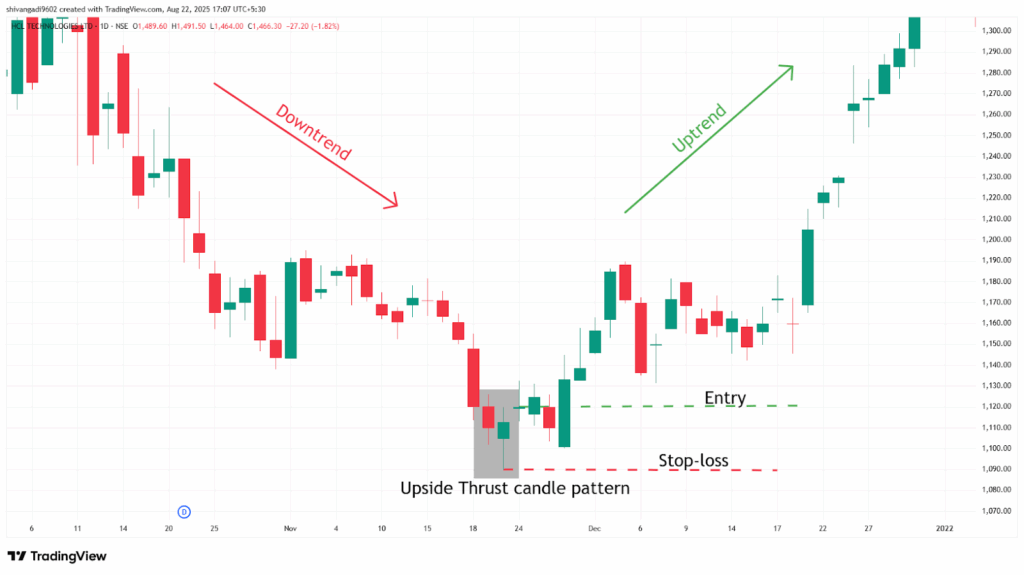

Entry:

- An entry to the long position can be placed at the open of the next candle after the formation of the upside-down thrust pattern.

Stop-loss:

- The stop loss for the long position can be placed at the low of the pattern formed.

Target:

- An ideal target is the next resistance line.

- The target for trade can be placed based on your risk-reward ratio.

- If you spot a reversal candlestick formed in the uptrend, after the confirmation, you can plan for an exit.

Example:

In the image below, you can look at the chart of “HCL Technologies Ltd” stock at a 1-day timeframe on 22nd and 23rd November 2021. You can see the buy signal generated using the upside-down Thrust candlestick pattern, as it is a trend reversal candlestick.

What are the advantages of Upside Thrust Candlestick?

- The low of the thrust candlestick can be used as a strong support level.

- The candlestick pattern is easy to identify.

- It provides a strong directional movement after it is formed.

- It provides a good risk-reward ratio, the stop-loss is low on the candlestick, and targets are at higher limits.

What are the disadvantages of the Upside Thrust Candlestick?

- In a sideways market, due to a lack of volume, it doesn’t work well.

- To set the target/exit, you will need to use other indicators or tools.

- It does not have a standard pattern, as the lower wick may or may not appear based on market conditions.

- False signals are possible without a bullish follow-up candle. Due to a lack of confirmation, this leads to a higher risk of false signals.

In Closing

In this article, we covered what is Upside Thrust candlestick pattern is, its structure, how to trade it, with the candlestick psychological pattern, an example of a trade scenario, and its advantages and disadvantages.

In the end, the Upside Thrust is a powerful bullish candlestick leading the price action and indicating the continuation of an uptrend, which makes it more efficient, and with proper risk management, discipline can pave the path to profitability. The Upside Thrust indicates multiple opportunities for clear entry and exit signals, making it an accessible tool for beginners.

Across all the financial markets in the world no indicator or tool that is 100% accurate. When combined with additional indicators or tools, the efficiency and accuracy are high.