In Technical analysis, there are candlestick patterns that are rare to spot, and when spotted, they give a strong directional movement according to...

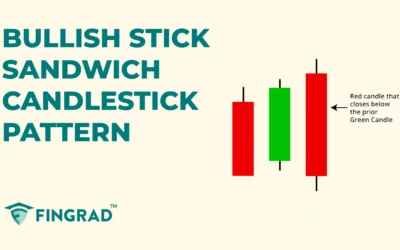

Bullish Stick Sandwich Candlestick Pattern: Structure and Trading

In Technical analysis, some candlestick patterns are rare to spot, and when spotted, they give a strong directional movement according to the type...

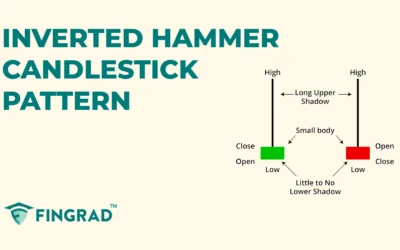

Inverted Hammer Candlestick Pattern: Structure and Trading

Technical analysis involves tools and indicators that provide you with a better understanding of the price action to develop your trading...

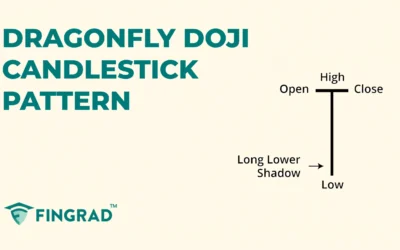

Dragonfly Doji Candlestick Pattern: Structure and Trading

In all financial markets, candlesticks display the sentiment of the price action and the strength of buyers and sellers. When the strength between...

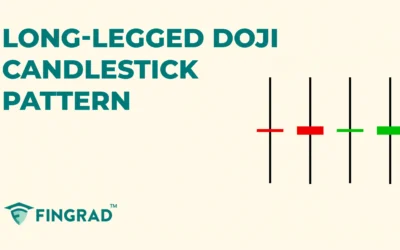

Long-Legged Doji candlestick: Structure and Trading

In technical analysis, candlestick patterns are one of the most effective tools for understanding market psychology and predicting potential price...

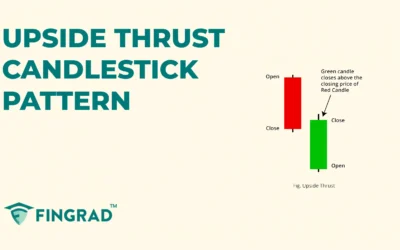

Upside Thrust Candlestick Pattern: Structure, Psychology and Trading

In trading or investing, identifying highly efficient, accurate, and low-risk candlestick patterns is hard, not impossible. The Upside Thrust is one...

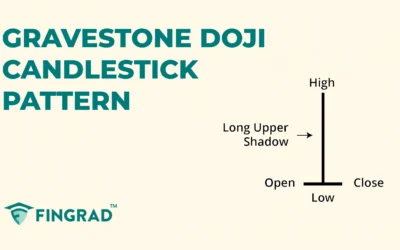

Gravestone Doji Candlestick Pattern: Structure and Trading

In trading, candlestick patterns are one of the most widely used tools to analyze market sentiment and predict potential price reversals. They...

Bearish Thrusting Candlestick Pattern: Structure and Trading

In trading, technical analysis is one of the most effective ways to understand market behaviour by studying price movements and chart patterns....

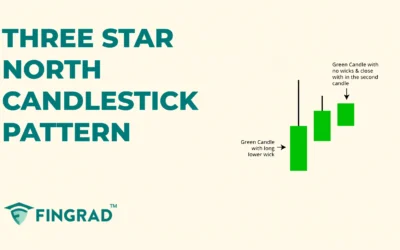

Three Star North Candlestick Pattern: Structure and Trading

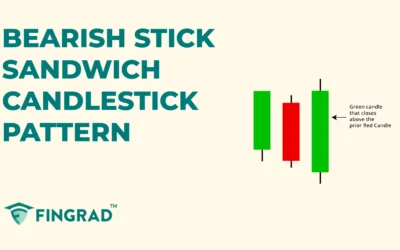

In Technical analysis, there are candlestick patterns that are rare to spot, and when they are spotted, they indicate a strong directional movement...

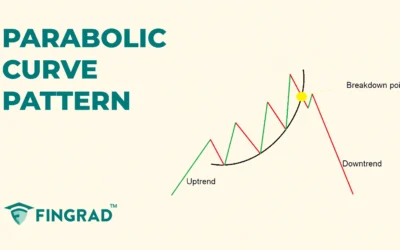

Parabolic Curve Chart Pattern: Structure and Trading

For new traders looking to understand trend shifts, learning chart patterns can help highlight potential reversals and continuations, though they...

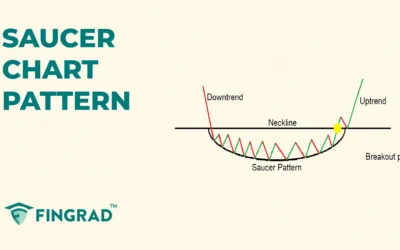

Saucer Chart Pattern: Formation and Trading

Across all the financial markets in the world, technical analysis gives an understanding of the price action and the strength of the buyers and...

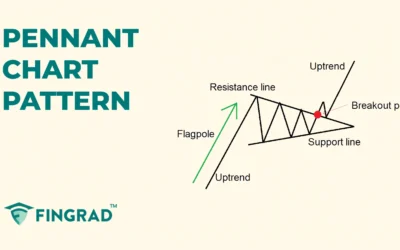

Pennant Chart Pattern: Structure and Trading

For new traders seeking to understand trend dynamics, learning chart patterns can help highlight potential reversals and continuations, though they...

Exhaustion Gap Pattern: Structure and Trading

In technical analysis, traders use a variety of tools and patterns to analyse price movement and have a huge impact on the price, provide a clear...

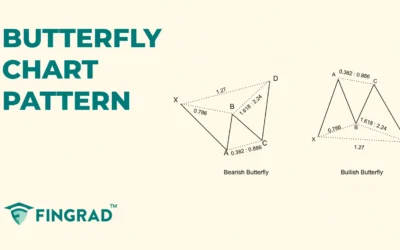

Butterfly Chart Pattern: Structure and Trading

When your trading is based on technical analysis, you are likely to come across tools and indicators. These tools include chart patterns, which...

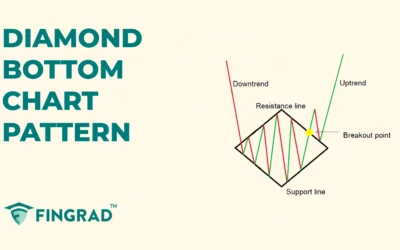

Diamond Bottom Pattern: Structure and Trading

When you begin trading, it is common to experience a form of overtrading, either to make profits, recover losses, or find the optimal entry and exit...

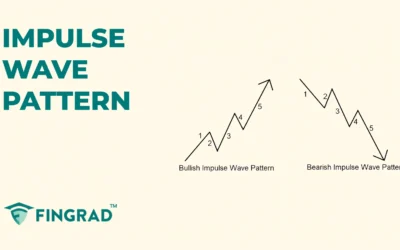

Impulse Wave Pattern: Formation and Trading with Example

In financial markets worldwide, chart patterns help traders analyse the price action, trend, and volatility of markets to identify trend reversals...

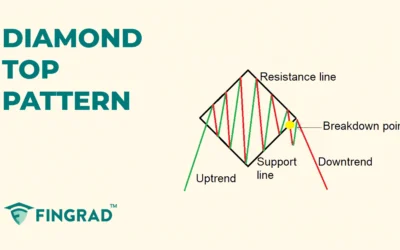

Diamond Top Chart Pattern: Formation and Trading

In Technical analysis, there are chart patterns that are rare to spot, and when spotted, they give a strong directional movement according to the...

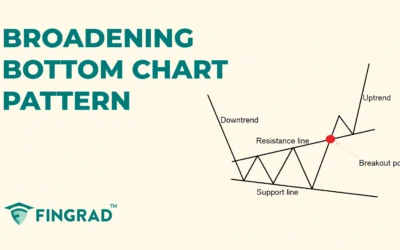

Broadening Bottom Chart Pattern: Formation and Trading

When trading with technical analysis, learning chart patterns can help interpret price action and structure trades more efficiently, though they...

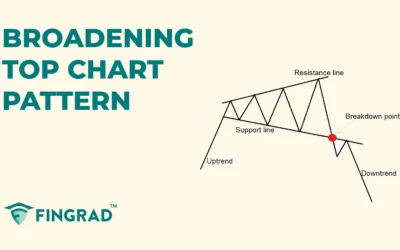

Broadening Top Chart Pattern: Structure and Trading

When you begin trading, you would want to avoid unnecessary risky trades. Then, learning chart patterns can help interpret price action and...

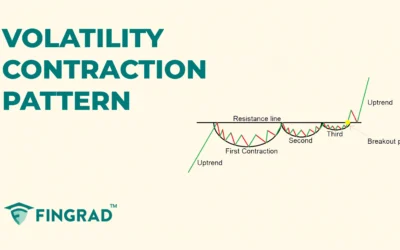

Volatility Contraction Pattern: Structure and Trading

Technical analysis involves trading with tools and indicators, which are powerful and reliable during your trades. One such pattern is the...

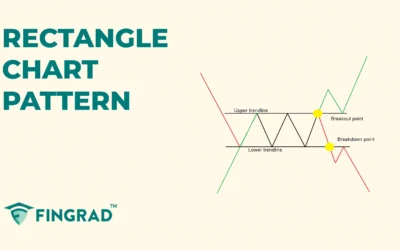

Understanding the Rectangle Chart Pattern in Technical Analysis

When you begin trading, you would want to avoid unnecessary risky trades. Then, learning chart patterns can help interpret price action and...

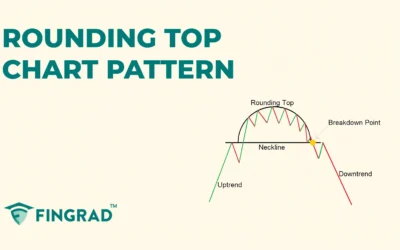

Rounding Top Chart Pattern: Structure and Trading

In trading, chart patterns play an important role in understanding market psychology and forecasting price movements. These patterns often highlight...

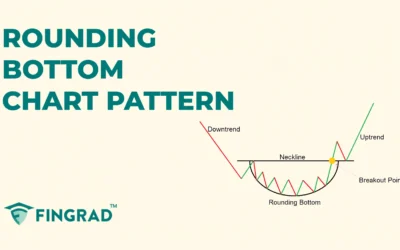

Rounding Bottom Chart Pattern: Structure and Trading

In trading, technical analysis plays a crucial role in helping traders understand price behaviour and predict future market trends. By studying...

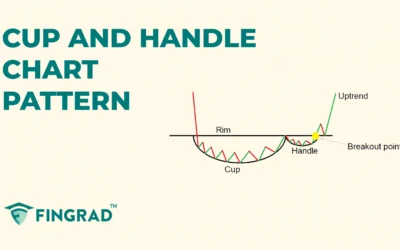

Cup and Handle Chart Pattern: Trading and Structure

New traders often struggle to spot and enter high-probability trades due to various scenarios, a lack of confidence in the trade, a lack of risk...

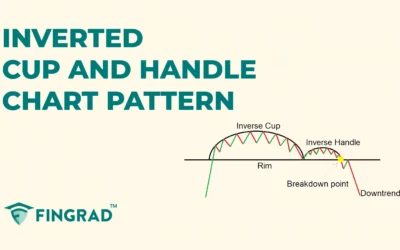

Inverted Cup and Handle Chart Pattern: Structure and Trading

If your trading is based on technical analysis, then you are likely to come across powerful indicators and tools, like chart patterns and many...

Bearish Island Reversal Chart Pattern: Structure and Trading

In technical analysis, chart patterns are a visual representation of price action, displaying the strength of buyers and sellers in the market or...

Bullish Island Reversal Chart Pattern: Structure and Trading

When trading price action-based using technical analysis, you may have encountered a chart pattern during the price action's consolidation phase....

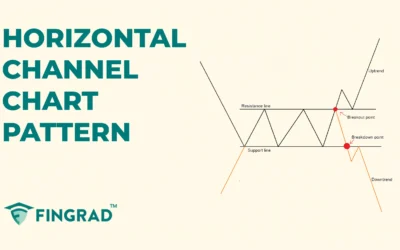

Horizontal Channel Pattern: Structure and Trading

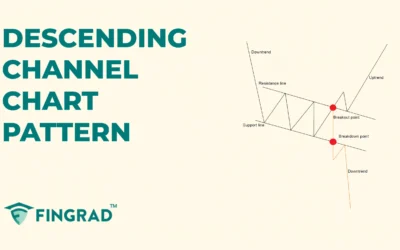

When your trading is based on technical analysis, then you might come across the chart pattern as they are visual representations of price movements...

Descending Channel Chart Pattern: Structure and Trading

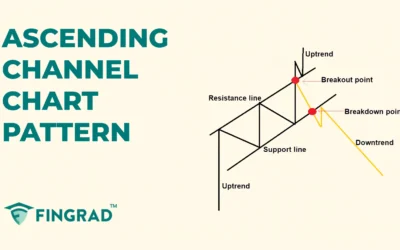

When you begin trading, you would want to avoid unnecessary risk and trade efficiently. Therefore, one must start learning the chart patterns, as...

Ascending Channel Chart Pattern: Trading and Structure

In trading, technical analysis is widely used to study price movements and identify patterns that reveal market behaviour. These patterns help...

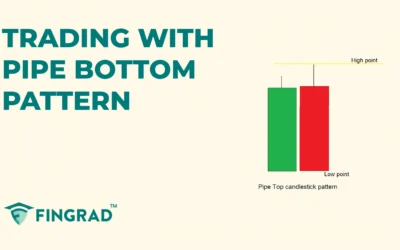

Pipe Bottom Candlestick Pattern: Structure and Trading

When you begin trading, you would want to avoid unnecessary risky trades. That’s when learning chart patterns becomes essential, as they are easy to...

Pipe Top Candlestick Pattern: Structure and Trading

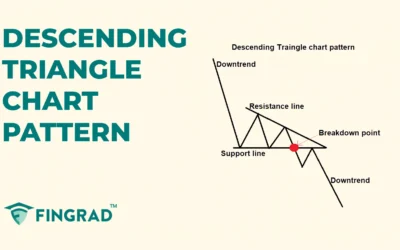

In trading, tools are widely used in technical analysis to study price movements and predict future market behaviour. These patterns reflect the...

Descending Triangle Chart Pattern: Structure and Trading

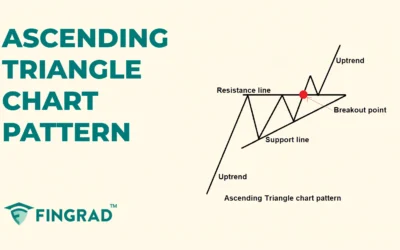

If you are a trader or an inventor using technical analysis for your trades, then you must learn about the powerful chart pattern that helps traders...

Ascending Triangle Chart Pattern: Structure and Trading

When you begin trading, you will want to identify the potential reversal and continuation of an ongoing trend. Then, you must learn about the...

Bearish Symmetrical Triangle Chart Pattern: Trading and Structure

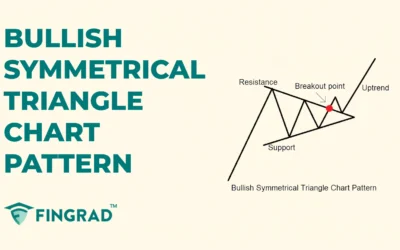

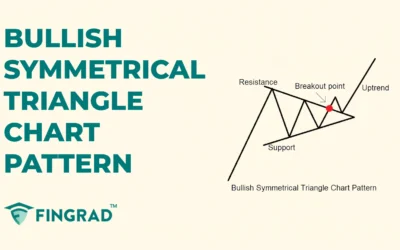

If your trading is based on technical analysis using tools and indicators, then it is important to understand the powerful chart pattern, as it...

Bullish Symmetrical Triangle Chart Pattern: Structure and Trading

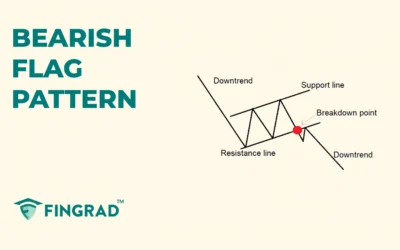

In trading, technical analysis helps traders study price charts and patterns to anticipate future market movements. Chart patterns, in particular,...

Bearish Flag Pattern: Structure and Trading

If you rely on technical analysis, you’ve likely come across powerful indicators and tools during your trade, such as candlestick patterns, which...

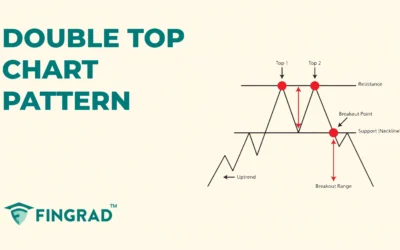

Double Top Chart Patterns: Structure and Trading

In technical analysis, chart patterns play a crucial role in helping traders identify shifts in market trends and make informed trading decisions....

Double Bottom Chart Pattern – Definition, Structure and Trading

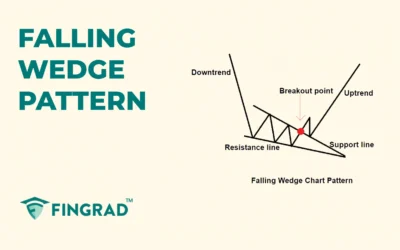

If your trading is based on technical analysis, you've likely encountered powerful candlestick patterns that help identify potential trend...

Falling Wedge Pattern

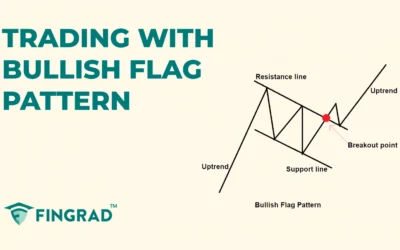

For traders seeking easily identifiable and impactful trend reversal signals. Then you must learn about the chart patterns, as they have a huge...

Bullish Flag Pattern: Structure and Trading

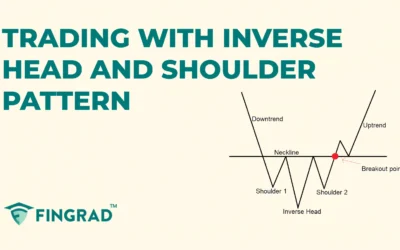

In technical analysis, chart patterns are essential tools that help traders understand price behaviour and predict future market movements. These...

Trading with Inverse Head and Shoulders Pattern

In trading, chart patterns are a key part of technical analysis, offering insights into how prices move and how trends may shift. These formations...

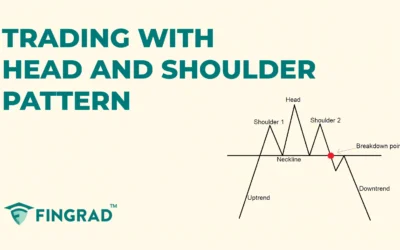

Trading with the Head and Shoulders Pattern

In trading, technical analysis plays a vital role in understanding market behaviour by studying price charts and recurring patterns. These patterns...

Trading with the Spinning Top candlestick pattern

When you are trading price action-based using technical analysis, you might have seen the candlesticks with a small body and long upper and lower...

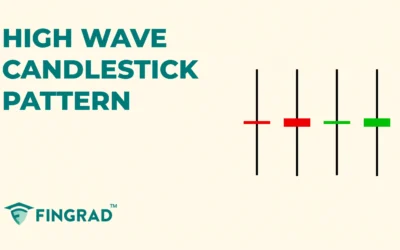

Trading with the High Wave Candlestick pattern

In security, when buyers and sellers are balanced, an indecision candlestick is formed, displaying the sentiment of the trading price action. For...

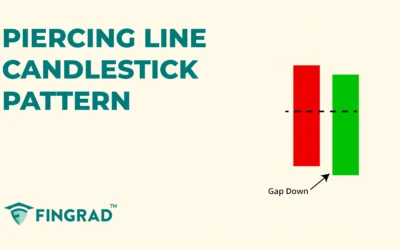

Trading with the Piercing Line Candlestick Pattern

In trading, the candlestick pattern offers a clearer understanding of price action, displaying the strength of buyers and sellers. There are...

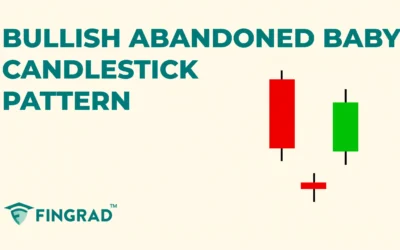

Trading with the Bullish Abandoned Baby Candlesticks Pattern

When you start trading it's hard to control your emotions on overtrading, then you must start to trade using the candlestick pattern which are rare...

Bullish Abandoned Baby Candlesticks Pattern: Trading and Psychology

In Technical analysis, some candlestick patterns are rare to spot, but when spotted, they give a strong directional movement according to the nature...

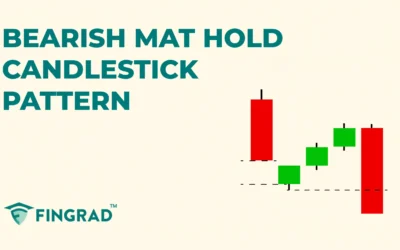

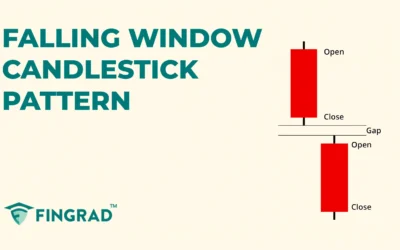

Falling Window Candlestick Pattern : Trading and Psychology

When you begin trading or investing, you may not be able to identify or enter the potential trades due to various scenarios, a lack of confidence in...

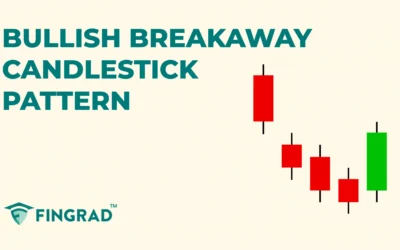

Bullish Breakaway Candlestick Pattern – Trading with Examples

In the world of technical analysis, candlestick patterns offer valuable insights into the price action and the sentiment of the buyers and sellers....