In technical analysis, candlesticks are a visual representation of price action, displaying the strength of buyers and sellers in the market or...

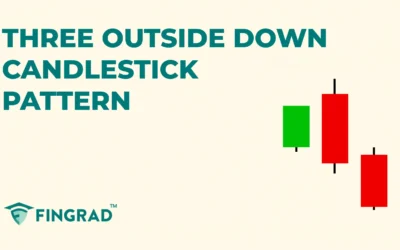

Three Outside Down Candlestick Pattern: Structure and Trading

When you begin trading or investing, you will want to capture the whole trend of the security. For such a strategy, the three-formation candlestick...

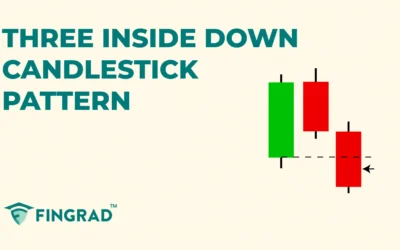

Three Inside Down Candlestick Pattern – Structure, Trading and Psychology

Technical Analysis gives you a better understanding of the market and its price action using tools and indicators represented by the candlesticks....

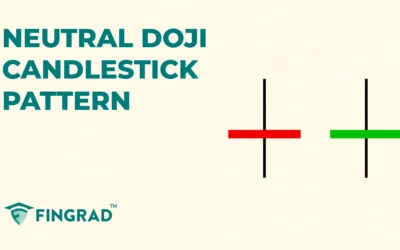

Neutral Doji Candlestick Pattern – Structure, Psychology And Trading

In trading or investing, there are single candlestick patterns. Those are capable of identifying potential trend reversals. They are easy to...

Three Rising Method Candlestick Pattern: Structure, Trading and Psychology

In technical analysis, candlestick patterns provide an understanding of market price action and potential trend reversals, and identify such...

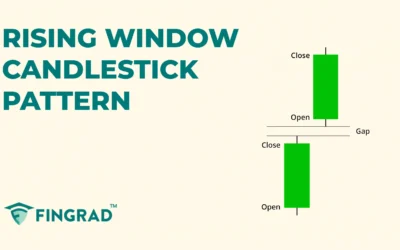

Rising Window Candlestick Pattern: Meaning, Psychology and Trading Strategy

When you begin trading or investing, you may not be able to enter all the potential trades due to various scenarios, a lack of confidence, or...

Ladder Bottom Candlestick Pattern: Meaning, Psychology and Trading Guide

In technical analysis, candlestick patterns are important for understanding and identifying market price action and potential trend reversals. The...

Ladder Top Candlestick Pattern: Meaning, Strategy and Trading

Across all the financial markets in the world, technical analysis gives an understanding of the market trend, the strength of the buyers and...

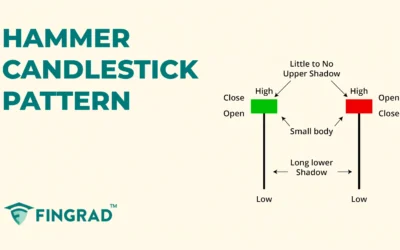

Hammer Candlestick Pattern: Meaning, Psychology and Trading

Technical analysis involves tools and indicators to develop trading strategies. Among such powerful tools that are easy to spot and trade and a...

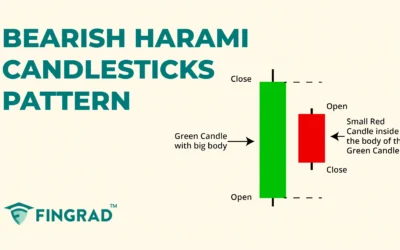

Bearish Harami Candlestick Pattern: Meaning, Strategy and Trading

Across financial markets worldwide, charts communicate the price action, trend, and volatility of markets. Technical analysis, when applied,...

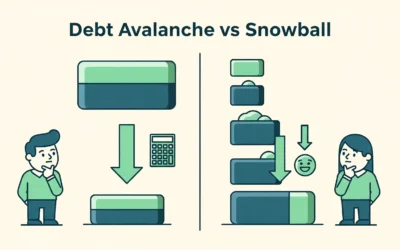

Debt Avalanche vs Snowball: Which Is Better?

Organising your debts can be a daunting and stressful task, particularly when you're balancing several payments, interest rates, and due dates....

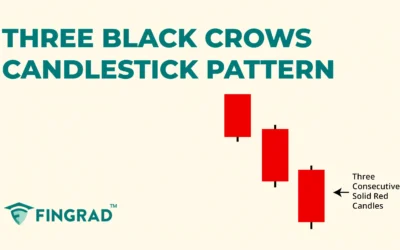

Three Black Crows Candlestick Pattern – Definition, Psychology and How to Trade

When you start trading or investing, you will want to identify the potential reversal with a quick movement after the confirmation, which is easy to...

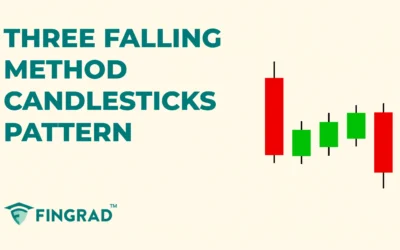

Three Falling Method Candlestick Pattern: A Complete Guide

Candlesticks display valuable insight into the market to identify potential trend reversals in price action and trade the security with an effective...

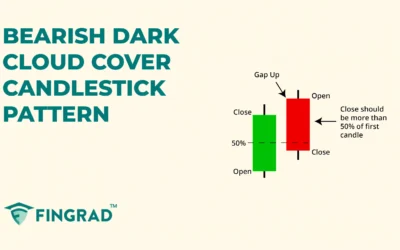

Bearish Dark Cloud Cover Candlestick Pattern: Definition, Trading and Psychology

For new traders seeking easily identifiable and impactful trend reversal signals indicated within the candlestick price action, they must learn...

How to Become a SEBI Registered Research Analyst

SEBI governs the stock market in India and is a reputable body. Being a SEBI-registered research analyst is a good career option and a milestone...

Advantages and Disadvantages of GST: A Comprehensive Guide (2025)

It was 2017 when the government of India decided to undertake major reform and introduce GST. It was one tax that replaced most of the others and...

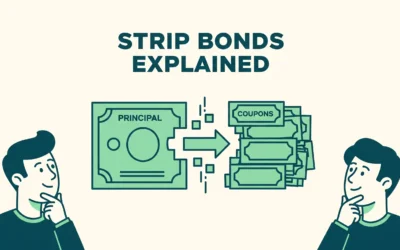

Strip Bonds Explained: Structure, Benefits and Limitations

There are different bonds available in the market, offered by the government and other organizations. Strip bonds ensure payment after the maturity...

Capital Losses: Can You Use Them to Save Tax?

Losing money is never pleasant, but what if the losses on your investments resulted in tax savings? Capital losses are not only disheartening in the...

How are ETFs Taxed in India?

Taxation on ETFs (Exchange Traded Funds) is dependent on various factors. But first, it is important to know that there are different types of ETFs....

What Is Capital Gains Tax and How to Calculate It

Imagine realising you owe the government a portion of your profit after selling your first property or cashing in on a stock you purchased years...

F&O Taxation in India 2025: Complete Guide for Traders

The F&O trading is expanding in India, accounting for more than half of the total trade volume across the world. But, still, there are many...

Tweezer Candlestick Patterns: Tweezer Top & Bottom Explained with Examples

In technical Analysis, candlestick patterns help traders understand the price action and offer valuable insights into potential reversals and trend...

Parabolic SAR Indicator – Meaning, Calculations and Limitations

In financial markets worldwide, charts reflect the price action, trend, and volatility of markets, which helps you understand the market and make...

What is a Swap Derivative? Features, Types, And Benefits

Financial instruments like derivatives are designed to manage or speculate on the value of underlying assets and can be traded either through...

What is Face Value in the Stock Market? Meaning, Formula and Myths

There are several accounting terms for determining the value of a company in different ways, such as book value, fair value, and face value. It...

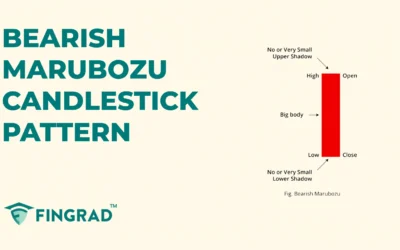

Bearish Marubozu Candlestick Pattern – Meaning, Psychology and Examples

If you rely on technical analysis, you’ve likely come across powerful indicators and tools during your trade, such as candlestick patterns, which...

Credit Cards Providing Lounge Access Without Any Spend-Based Conditions 2025

Who doesn’t like the comfort of an airport or railway lounge? Many individuals who travel for business purposes are in a hurry. Chilling in the...

What Is Market Coupling? Understand How it Affects IEX

NSE and BSE are major stock exchanges in India with rapidly changing prices. However, market coupling relates specifically to power exchanges like...

Tax on ULIP Maturity: ULIP Tax Exemption Rules Explained 2025

Managing all your investments and insurance is a tedious task for an individual. ULIP or Unit Linked Insurance Plan makes your personal finances...

Best Government Investment Schemes In India

The government offers investment schemes to channelize the savings in an economy. When an individual saves more, they ultimately want to invest it...

Fractional Investing in Real Estate and Startups: Opportunities and Pitfalls in Shared Ownership

People like investing to fulfil the main goal of growing their capital and building wealth in the long run. Real estate is one of the most trusted...

Shadow Banking Explained: Its impact on everyday savers and SMEs

In an economy, all financial institution, such as banks, plays an important role. But there are other factors and intermediaries that are crucial...

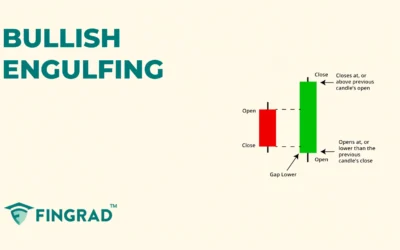

Bullish Engulfing Candlestick Pattern

When you begin trading, you would want to avoid unnecessary risky trades. Then, one must start learning the candlestick patterns, as they are easy...

Navigating home loan balance transfers: Pros, cons, and process

Taking home loans is a good way of fulfilling your dream or need to own a house. It may seem like a long-term liability, but if managed properly,...

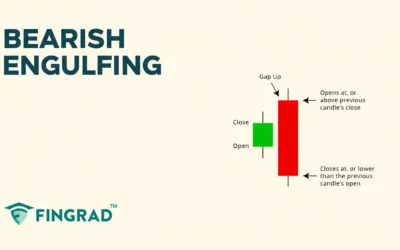

Bearish Engulfing Candlestick Pattern

For traders seeking easily identifiable and impactful trend reversal signals. Then you must learn about the candlestick patterns, as they have a...

How to Invest in Commodities: Gold, Silver, Oil

Investing in commodities is not a new concept. People have been doing it for ages in the form of previous metals. They are not just investments but...

TDS on Mutual Funds – Section 194K

Investing in a mutual fund and earning a return may seem easy with the increase in technology and accessibility. But many investors make the mistake...

Pivot Points Indicator: Meaning, Calculation & Trading Strategies

In the Stock Market, charts display price action, which helps you understand the market and make better entry and exit points. Technical analysis...

Evening Star Pattern – Meaning, Formation, How to Use

Candlestick patterns are essential tools in technical analysis that help clarify the price action of a security. One such pattern is the Evening...

What is Dearness Allowance in Salary

Government employees are entitled to many benefits. Dearness Allowance is one of them. Individuals often fail to understand their salary break-up in...

Joint Home Loan: Benefits and Tax Implications

Owning a house is a dream for many and also a big milestone to achieve. But due to rising prices of real estate, it becomes difficult for an...

How to Invest in Distressed Securities

The majority of investors often rely on tips from social media platforms or any person to make their investment decision. Because of this, you can...

What Are Smart Beta ETFs and How Do They Outperform Traditional Index Funds?

Taking investment decisions is often influenced by herd mentality and bias. Too much reliance on other sources and opinions of other people may stop...

What Are Floating Rate Notes and How to Invest in Them Safely

Apart from equity, there are various other debt instruments that are good for investments. FRNs or floating rate notes are one of such investment...

Types of Capital Market Instruments in India

India is a developing country. Government and businesses often require money for their growth and development, which they raise from the public. The...

Best App for Mutual Funds in India 2025

Mutual funds are a good way of investing. Investors rely on it especially when they are beginners or less experienced. But in many cases, there is a...

SOA vs Demat: Which is Better for Mutual Fund Investors

Many mutual fund investors think that a demat account is the only way in which they can begin investing in mutual funds. But this is not the case....

NISM Certification: All You Need To Know

The industry of finance is highly competitive and requires good qualifications and experienced personnel. There are many courses that an individual...

Universal Basic Income: Could It Work in India?

The government is responsible not only for looking after the infrastructure and finances but also for its citizens. Universal Basic Income is an...

Expense Tracker Apps That Sync with Indian Banks in 2025

Tracking expenses is a healthy habit that every individual should follow. It helps in analysing where you are spending most of your money. Whether...