With the advancement in technology, it has never been easier to manage finances. In 2025, the dependency on online budgeting applications has increased. All it takes is an initiative to start a budget.

This is the list of the best budgeting apps in India that have different USPs and hence fit the suitability of different individuals.

Walnut

Founded: 2014

Active Users (2025): 7 million+

USP: It is an offline supporting SMS based app with auto-expense tracking.

Key features

- It does not require an internet connection to operate as it provides offline services.

- It tracks bank balances and transactions via SMS.

- Bill reminders are also added to remind customers of upcoming payments.

- Automatic expense categories are generated, making it easy to categorize spending.

- The application includes graphical reports, making it simpler to visualize financial information.

Pros:

- Scans SMS for auto-categorization

- Operates offline

- Sync with bank account balance

- It supports automation, making it hassle-free.

Cons:

- No investment monitoring

- UI is less up-to-date compared to newer apps

Goodbudget

Founded: 2009

Active Users (2025): 3 million+

USP: Envelope-style budgeting, and it allows syncing across devices.

Key Features:

- It operates according to the envelope budgeting system.

- Allows users to manually add money to spending categories

- Syncs with several devices

- Offers debt monitoring and planning for objectives

- No syncing with bank (includes a manual discipline factor)

Pros:

- Encourages responsible expenditure using manual entry

- Excellent for joint budgets and couples

- Simplified and minimalistic user interface

- Perfect for individuals with irregular incomes

Cons:

- No automatic banking syncing

- Less real-time data analysis

- It does not provide automation and hence can be a problem for some users.

Money Manager by Realbyte

Founded: 2012

Active Users (2025): 10 million+ globally

USP: Double-entry bookkeeping with good visual representation.

Key features

- Data must be manually entered into the application.

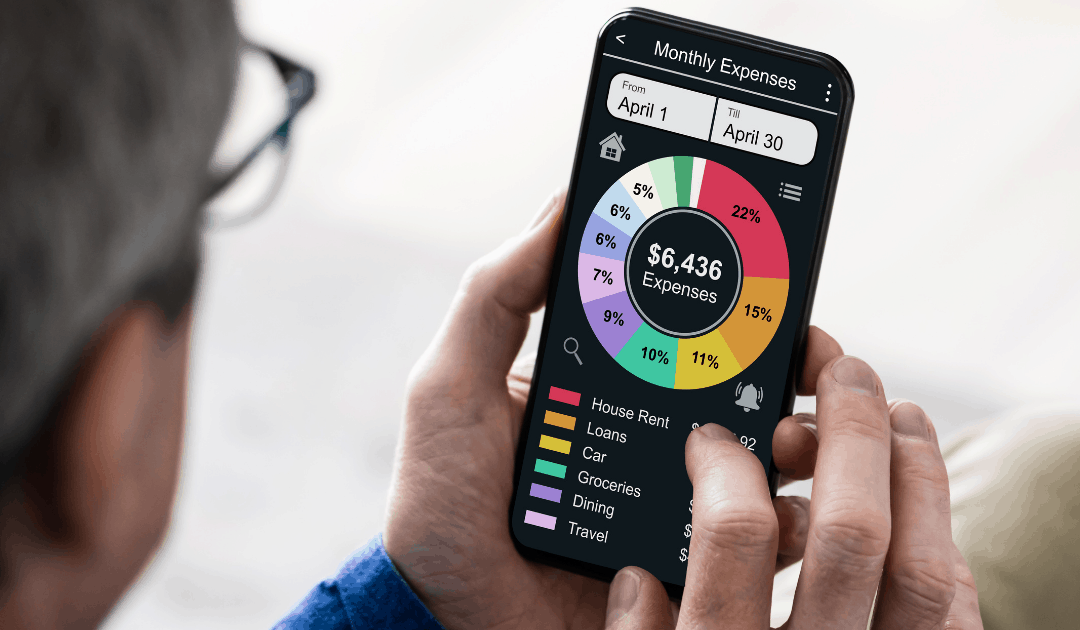

- The app provides graphical reports, including pie charts and bar graphs.

- To guarantee the security of user data, passcode protection is included.

- Only the premium version offers cloud backup.

- Users have the option to export their data to Excel for additional analysis or documentation.

Pros

- Easy-to-use interface

- Visually appealing financial reports.

- accommodates numerous accounts

- Passcode for privacy

Cons

- No bank integration

- The free version has limitations.

ET Money

Founded: 2015

Active Users (2025): 10 million+

USP: Provides the facility of tracking investment, tax planning, and insurance along with budgeting.

Key features

- The app can automatically track transactions by reading bank SMS messages.

- To assist users in keeping an eye on their investments, it offers mutual fund tracking.

- There are options for tax savers to help with effective tax planning.

- For improved insurance policy management, the app has insurance tools.

- Users get tailored insights based on their data and financial behavior.

Pros

- Monitors investments and expenditures

- Tax-saving ideas

- Analysis of mutual funds

- User-friendly interface

Cons

- SMS permissions are required.

- Product advertisements

YNAB (You Need A Budget)

Founded Year: 2004

Active Users (2025): Millions globally (exact number not disclosed)

USP: Envelope-style (zero-based) budgeting with flexible, rule-based money management and robust device syncing.

Key Features :

- Zero-based (envelope-style) budgeting

- Real-time syncing across devices and with bank accounts

- Customizable categories, goal tracking, and detailed reports

- Flexible budget adjustments and easy money reallocation

- Supports shared budgets for couples or families

Pros

- Promotes proactive, intentional money management

- Highly customizable and user-friendly interface

- Strong educational resources and support

- Great for joint budgeting and financial transparency

Cons

- Requires a paid subscription—no free version beyond trial

- Manual entry can be time-consuming if not using bank sync

- No investment tracking or bill payment features

Bottomline

The ecosystem of budgeting apps in India in 2025 provides strong tools suited to various user requirements. There is a budgeting app that suits your needs, whether you manage a family budget, invest, or spend money frequently. Analyse the purpose of making a budget and choose wisely.

Written by: Tanya Kumari